This post was orginally posted by Audit Analytics.

This post will be updated to reflect the current number of filings citing the COVID-19 pandemic in a going concern opinion, key audit matter, or emphasis of matter.

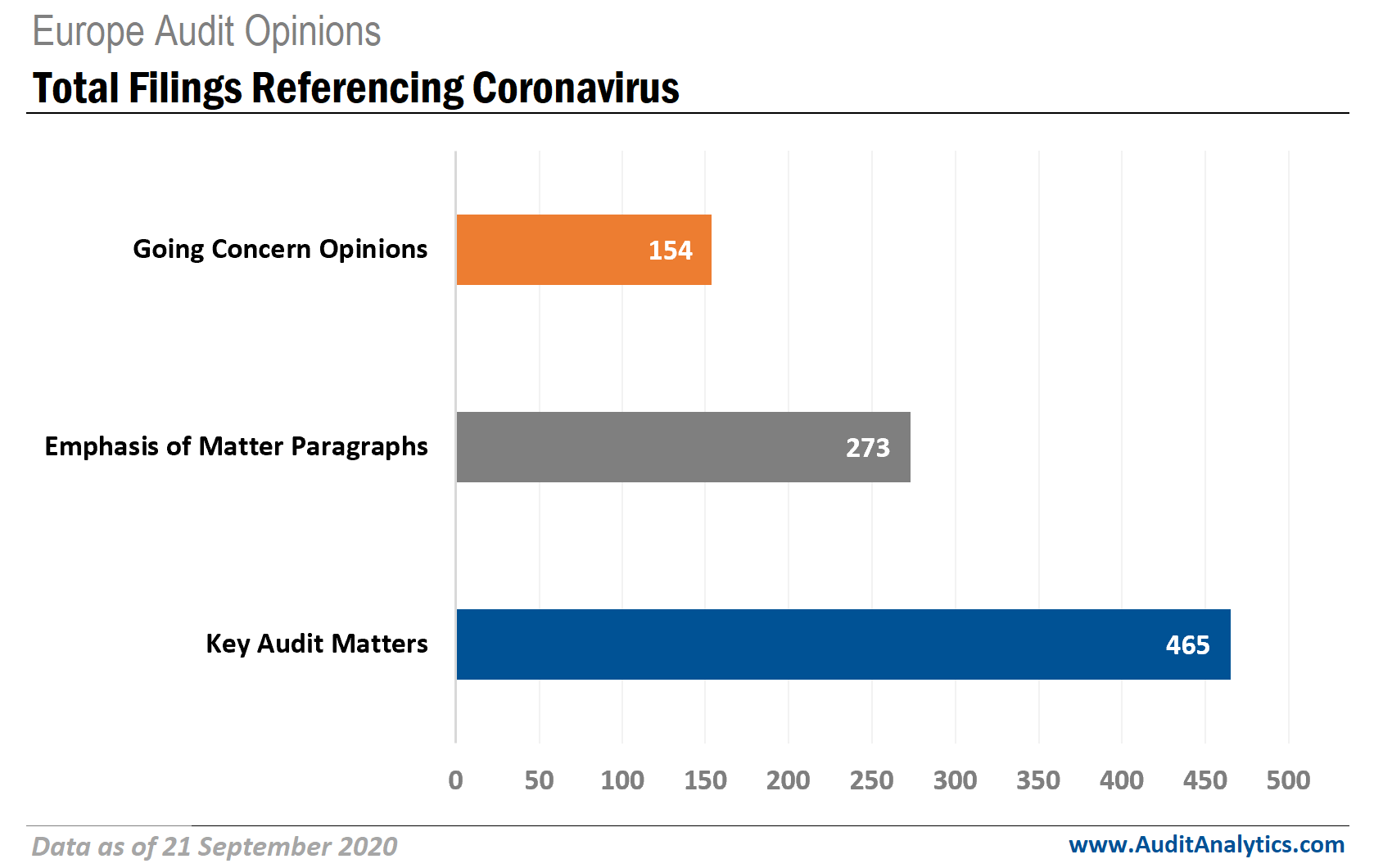

As of the week ended 18 September 2020, Audit Analytics has observed the following trends in European audit opinions referencing COVID-191:

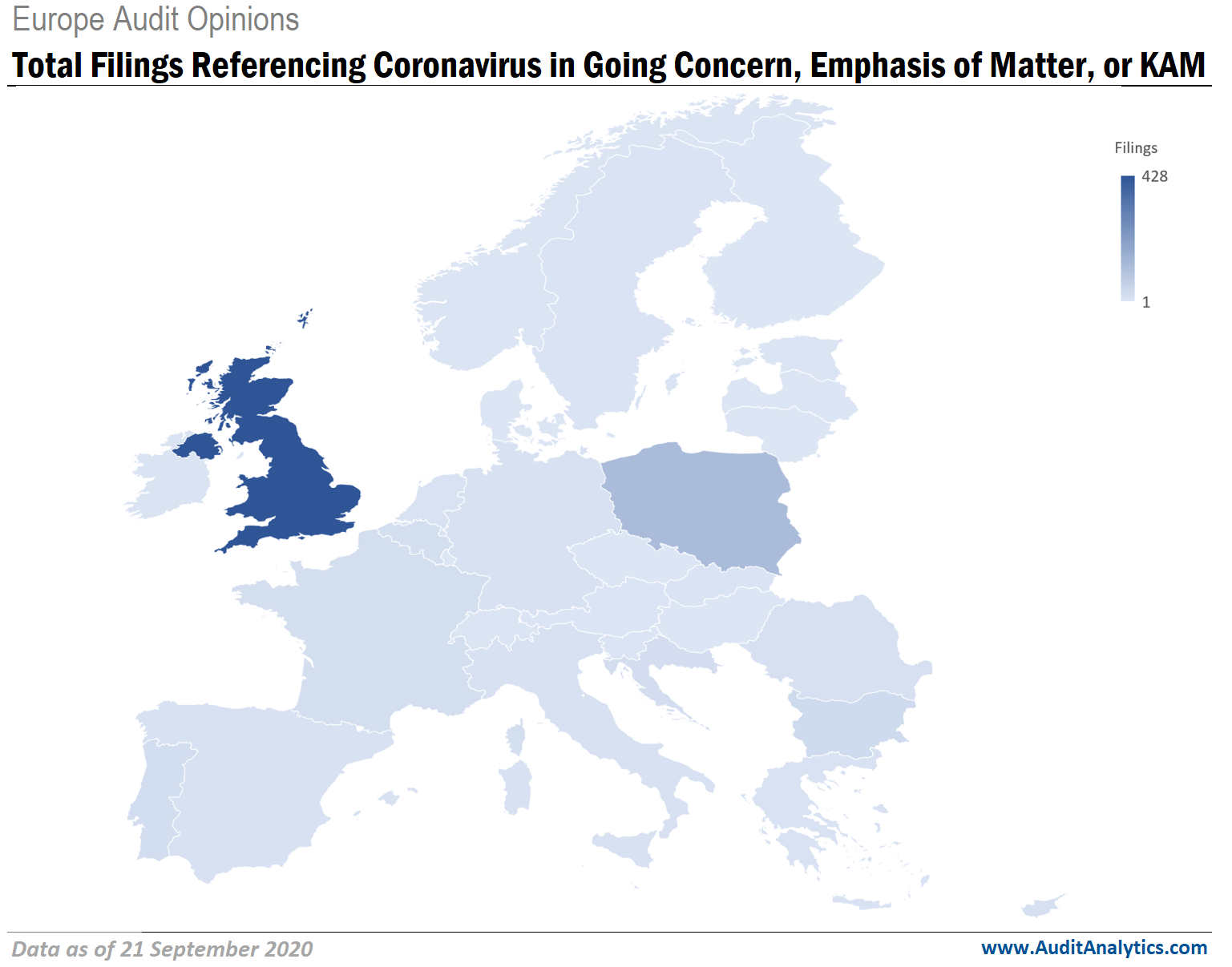

Based on company headquarters, the United Kingdom has continued to see the most audit opinions referencing COVID-19, with over 425 references to the pandemic in a going concern modification, a key audit matter (KAM), or an emphasis of matter paragraph. Poland comes in second, with just over 120 references in audit opinions concerning the coronavirus in those components of the audit opinion. A distant third is Bulgaria, with 35 references to the pandemic in an audit opinion.

A going concern modification is the expressed uncertainty that a company is able to continue in the near future. Generally speaking, this uncertainty relates to whether the company will exist for another 12 months. The specifics of the long-term and extensive impacts of the coronavirus are currently unknown, but it is known that COVID-19 has the potential to materially impact operations across a wide variety of companies.

As of the week ended 18 September 2020, non-Big Four auditors have signed the majority of going concern audit opinions for European filers referencing COVID-19.

The vast majority (77%) of companies receiving going concern audit opinions are small- cap companies, with a market capitalization under €100 million, suggesting that smaller companies are continuing to be significantly impacted by the uncertainties surrounding the COVID-19 pandemic.

Of the companies that have received a going concern audit opinion related to coronavirus, 26% are in the Services industry. This is understandable, as many companies in this sector rely on providing some type of service to their consumers; the uncertainty of the economic impact of the pandemic may alter consumer spending habits, leading to less consumers seeking out the services these companies provide.

KAMs are intended to increase the usefulness and information provided in the auditor’s opinion. The disclosures made by the auditor are supposed to describe an area of significant audit risk, a summary of the auditor’s procedures to test the audit area, and any key observations of the auditor with respect to that risk (where appropriate). Considering the uncertainties regarding future impacts of the coronavirus pandemic, auditors may address the risk of that uncertainty in a KAM.

As of the week ended 18 September 2020, non-Big Four auditors have identified the most KAMs related to COVID-19 in audit opinions for European filers (42%); out of the Big Four, PwC has signed the most opinions with a COVID-19 reference in a KAM (28%).

The majority (53%) of companies receiving KAMs related to the coronavirus have been small- cap companies with a market capitalization under €100 million.

Nearly 30% of companies that have received a KAM related to the pandemic to this point have been in the Finance, Insurance, and Real Estate industry, while 23% have been in the Services sector.

An emphasis of matter paragraph is a component of the auditor’s report on financial statements that addresses matters that the auditor considers is fundamental to the overall understanding of financial statements. Given the widespread effects of coronavirus on companies and their financials, it is not surprising to see the COVID-19 pandemic mentioned as an emphasis of matter in financial statements.

As of the week ended 18 September 2020, the Big Four firms have each signed more than ten audit opinions that reference COVID-19 in an emphasis of matter paragraph for European filers; while EY has signed more than 20. Non-Big Four auditors have collectively signed over 200 opinions containing an emphasis of matter related to the pandemic.

The non-Big Four majority is reflected in that roughly 77% of the companies with an emphasis of matter paragraph referencing the pandemic are small- cap companies, with a market capitalization under €100 million.

Nearly 30% of companies to have an audit opinion referencing the coronavirus are in the Manufacturing industry, while 45% are in the Services or Finance, Insurance, and Real Estate sectors. The Real Estate sector has been particularly impacted, as the uncertainty surrounding the potential economic effects of the coronavirus pandemic poses a challenge for the valuation of properties; observable market activity informs valuation, but due to the unprecedented current circumstances, there are no comparable market condition with which to inform opinions on value. This can result in material valuation uncertainty, an important aspect of financial statements, a potential contributing factor in an emphasis of matter paragraph.

For more information about Audit Analytics or this analysis, please contact us.

Interested in our content? Be sure to subscribe to receive our email notifications.

1.This analysis is based on audit opinions collected by Audit Analytics. Weekly totals reflect the total number of filings per week and may change over time as filings are added to the database. Firms without an available market cap are excluded from the market cap analyses in the tables, but are included in the weekly totals. For dual signed audit opinions, both auditors are included in the auditor analyses in the table and are included in the cumulative count by auditor, but the opinion is counted once in the weekly totals.