This analysis was originally posted by Audit Analytics.

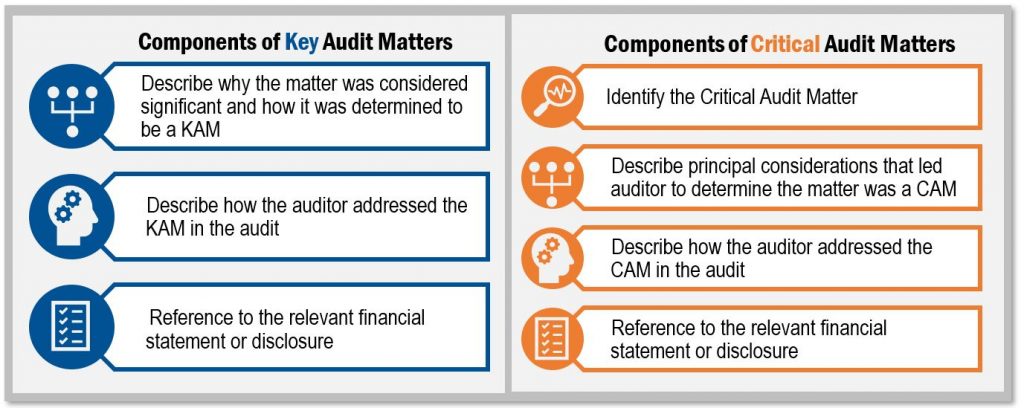

In the United States, audit firms of large accelerated filers with fiscal years ending on or after June 30, 2019 are required to disclose Critical Audit Matters (CAMs) in their audit reports. For 53 of these large accelerated filers that are also listed on European exchanges, Key Audit Matters (KAMs) have already been required across Europe for over a year and a half. Though both matters have complex nuances, the criteria for KAMs, provided by the International Federation of Accountants (IFAC), and the criteria for CAMs, provided by the Public Company Accounting Oversight Board (PCAOB) includes:

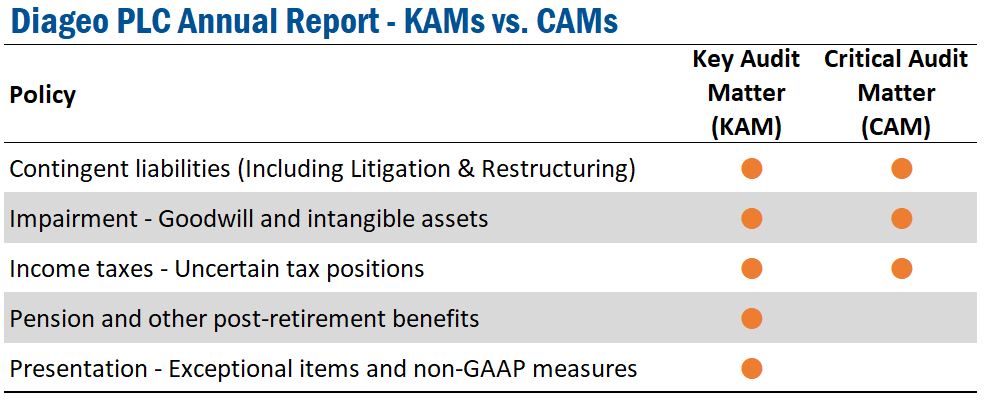

Diageo PLC [NYSE:DEO; LSE:DGE] was the first cross- listed company to file annual reports containing both KAMs and CAMs. Let’s look at how they compare.

There were five KAMs disclosed in Diageo’s annual report, in comparison to three CAMs. A contributing factor to the difference in the number of key versus critical matters is that the PCAOB focused CAMs for SEC filers on matters that are material to the financial statements, while the IFAC focused KAMs on matters most significant during the audit.

“Post employment benefit obligations” – or to use Audit Analytics’ taxonomy, Pension and other post-retirement benefits – is a KAM because of the significance of this liability in the context of the overall balance sheet. As seen below, PwC cites almost 10 billion GBP as the value of obligations and notes that movements in estimated assumptions of liability can have an impact in determining the liability.

Post employment benefit obligations: The group has approximately 40 defined benefit post employment plans. The total present value of obligations is £9,498 million at 30 June 2019, which is significant in the context of the overall balance sheet of the group. The group’s most significant plans are in the United Kingdom, Ireland and United States. The valuation of pension plan liabilities requires estimation in determining appropriate assumptions such as salary increases, mortality rates, discount rates, inflation levels and the impact of any changes in individual pension plans. Movements in these assumptions can have a material impact on the determination of the liability. Management uses external actuaries to assist in determining these assumptions.

This rose to the level of a KAM due to the significance of post-employment benefit obligations during the audit of the financial statements.

The other KAM topic not listed as a CAM is “Presentation of exceptional items (group)” – classified by Audit Analytics as Presentation- Exceptional items and non-GAAP measures. The US-based Financial Accounting Standards Board (FASB) eliminated exceptional/extraordinary items in 2015 and the SEC does not allow reporting of non-GAAP financial metrics in audited financial statements. For this reason, we can be certain that exceptional/extraordinary items will never be a CAM.

Diageo’s remaining three KAM topics are the same as its CAMs, demonstrating that there are similarities between KAMs and CAMs. Due to the likeness, the topics and the number of KAMs that have been disclosed can provide insight to the topics and number of CAMs that will be disclosed.

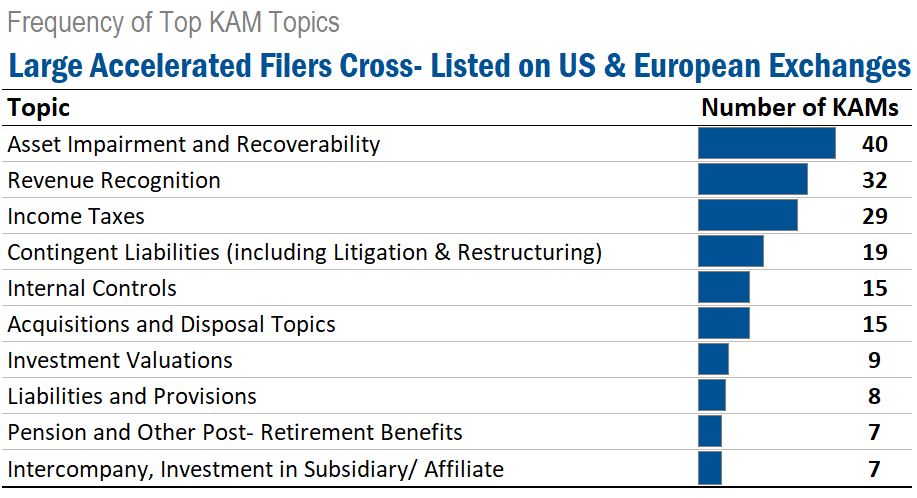

To illustrate potential trends with the topics that CAMs will address, let’s look at the most recent KAMs cited by auditors of cross- listed companies that are expected to file annual reports containing CAMs this year.

The following table shows the most cited KAM topics identified for large accelerated filers cross- listed on a US and European exchanges. Asset impairment and recoverability was the most common, included as a KAM for 64% of the companies, followed by revenue recognition which was included as a KAM for 51% of companies.

So how many CAMs can we expect to be identified from cross- listed companies that also disclose KAMs? The exact number is hard to determine, but we can expect there will be fewer CAMs than KAMs for reasons like those occurring during the audit of Diageo PLC, including that exceptional/extraordinary items will never be a CAM due to differing disclosure requirements between US and foreign filers. Additionally contributing to differences with topics is that CAMs consider materiality to the financial statements versus KAMs that consider significance of a matter to the audit.

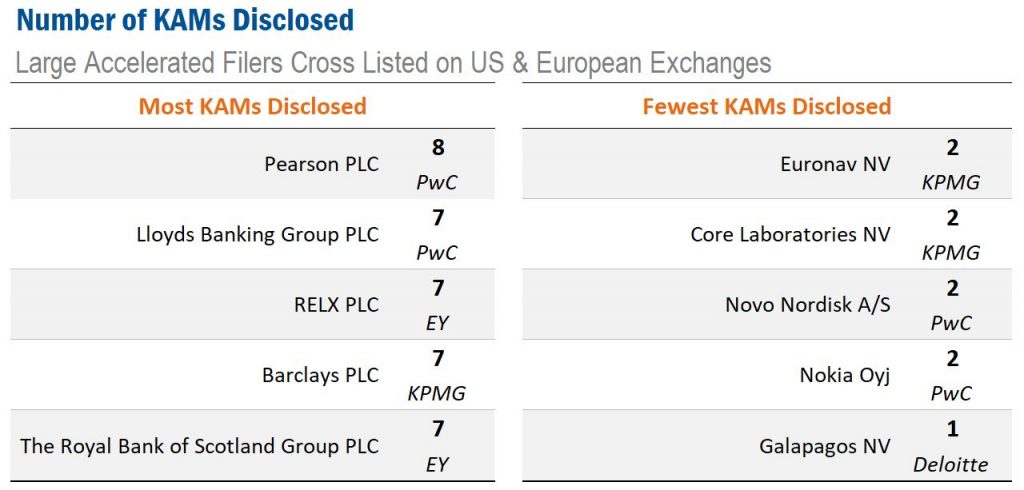

To get a sense of the number of CAMs that may be disclosed in annual filings, we looked at cross- listed companies with the most and fewest KAMs in their recent annual report.

Although it’s too soon to say for certain, we expect to see similar trends with CAMs as we have seen with KAMs.

For more information about KAMs or CAMs, please contact us.