This analysis was originally posted by Audit Analytics.

When considering the concentration of the audit market – that is, how competitive the market is between audit firms – there is more than one way to measure control of the market beyond the number of clients an audit firm has.

In this post, we look at three different metrics of audit market concentration, namely: 1) the number of clients audited, 2) the total market capitalization audited, and 3) the total audit fees audited. We compare these metrics between two European audit markets: A) companies listed on the main market of London Stock Exchange, and B) companies listed in Germany, particularly on the XETRA venue.

For both markets, we base our analysis on the audit firm that signed the fiscal 2017 audit opinion and the corresponding audit fees. Market capitalization is matched as closely as possible to the fiscal year end of each company.

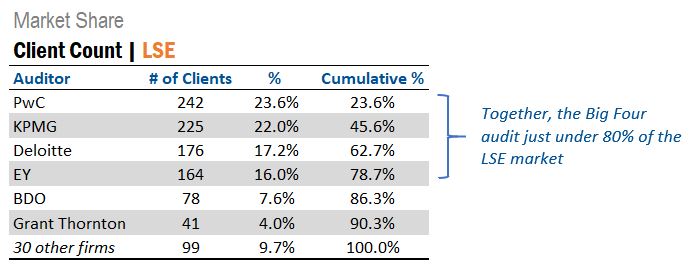

London Stock Exchange

First let’s look at client counts.

The Big Four firms audit nearly 80% of all the companies listed on the London Stock Exchange (not including AIM). Together with BDO and Grant Thornton, the top six firms audit 90% and 30 other firms audit the remaining 10%.

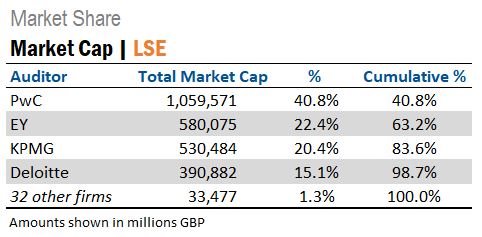

Turning to market capitalization, the concentration at the top is extreme.

In this case, the Big Four audit 99% of the total market capitalization of the London Stock Exchange.

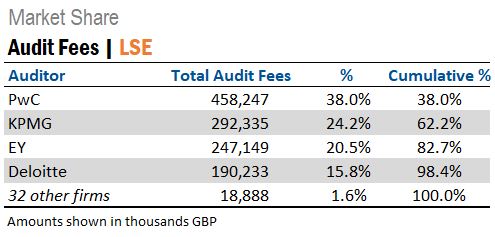

Lastly, we look at audit and audit-related fees.

When considering audit fees, the market is more concentrated than by client count, but a little less concentrated than when looking at market cap.

The Big Four account for 98% of all audit and related fees paid by companies on the London Stock Exchange.

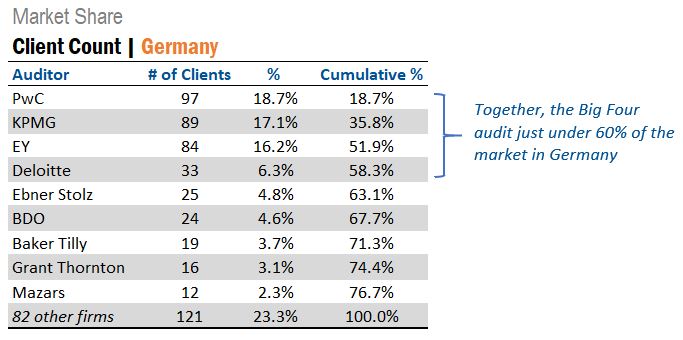

German Stock Exchange

For comparison, let’s look at companies listed in Germany.

Again, we start with client counts.

Compared to the London Stock Exchange, Germany is less concentrated. The top nine firms by client count account for less than 80% of the total market, and no single firm has more than 20% of the market. Meanwhile, 82 other firms compete over the remaining 23% of the market.

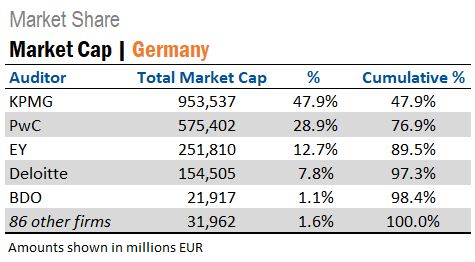

When we look at market capitalization, however, a very different picture emerges.

KPMG audits nearly 50% of the market capitalization alone, and the Big Four audit 97% of the total.

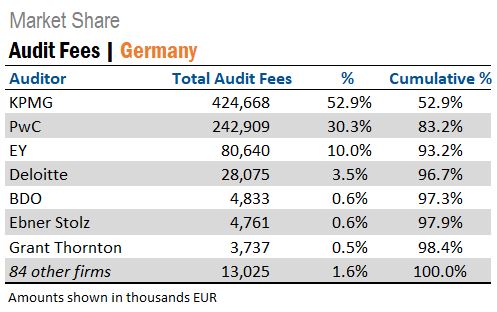

Audit fees tell a similar story.

KPMG actually has more than 50% of the total audit and audit-related fees paid in 2017. And the Big Four have 97% of the total.

For more information on this analysis, contact us at info@auditanalytics.com.