This analysis was originally posted by Audit Analytics.

The disclosure of Key Audit Matters (KAMs) has been required for over a year now, and there is a lot of data available to be analyzed. In this post, we look at the KAM disclosures of more than 1,200 companies over the past three years and discuss some interesting trends that we see in the data.

KAMs are required under ISA 701 for fiscal years ending on or after December 15, 2016. Therefore, fiscal 2017 is the first full year of Key Audit Matter disclosures.1

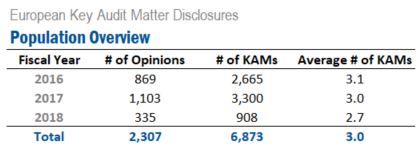

Population Overview

For this analysis, we looked at over 2,300 audit opinions of 1,201 large-, mid-, and small- cap companies listed on 47 indexes across 31 European countries.

Reviewing the Key Audit Matters of audit opinions disclosed since 2016, the average number of KAMs per audit opinion sits around three.

Key Takeaways

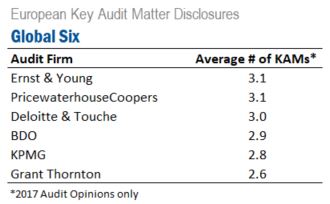

Breaking down the KAM disclosures of companies audited by the Global Six audit firms for fiscal 2017 only – the first full year of data – we see that there are slight differences in the average number of KAMs disclosed among audit firms, ranging from 2.6 (Grant Thornton) to 3.1 (both EY and PwC).

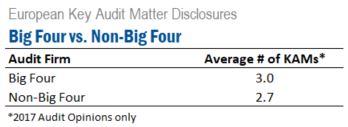

When comparing the Big Four vs. other audit firms – again for 2017 only – we see a similar difference. The Big Four average right around three KAMs per disclosure, while all other firms average slightly less than three.

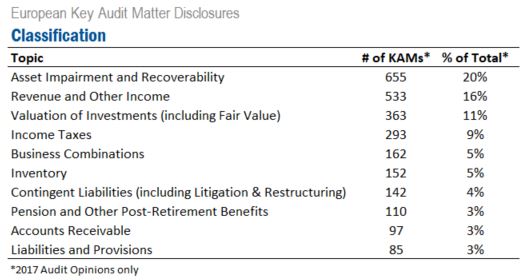

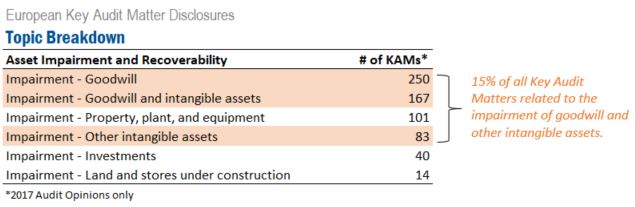

The most common topic addressed in 3,300 KAMs disclosed by 1,100 companies in fiscal 2017 were Asset Impairment and Recoverability, comprising 20% of all KAMs. Revenue and Other Income and Valuation of Investments follow at 16% and 11%, respectively.

Drilling down into a more granular breakdown of the Asset Impairment and Recoverability topic, we see that 15% of the 3,300 KAMs disclosed by 1,100 companies in 2017 related to the impairment or recoverability of goodwill and other intangible assets.

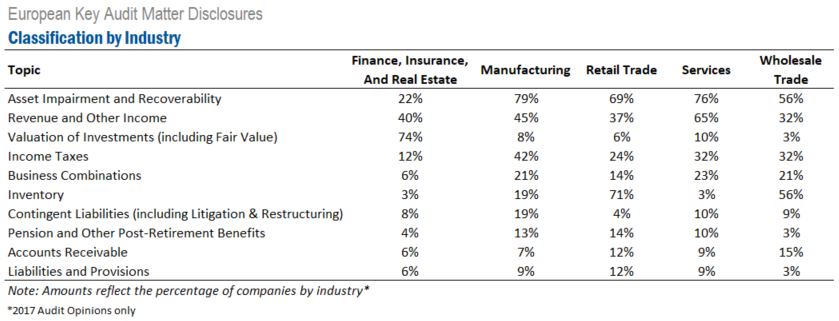

Lastly, in the chart below, we present the percentage of companies in select industries that cited particular issues in at least one of their KAMs. (Industries are based on the SIC top-level divisions.)

For more information on this analysis, please contact us at info@auditanalytics.com.

1. 2016 is a partial year since it only covers companies with fiscal year ends on or after 12/15/16, and fiscal 2018 is a partial year right now because the vast majority of companies have 12/31 year ends and most haven’t issued annual reports yet.