This analysis was originally posted by Audit Analytics.

Cash may be king, but when it comes to auditing, cash is not usually considered a high risk area. The audit procedures around cash usually begin and end with confirming the balance on hand with the company’s banks, and there is very little estimation involved in the balance.

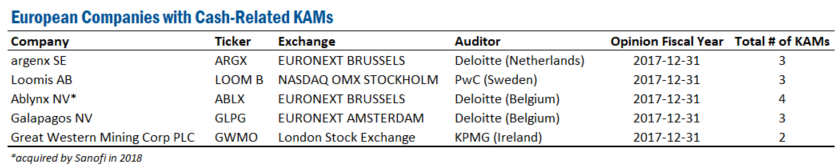

Despite the relative ease of auditing cash, we found a handful of cases where audit firms identified cash or cash equivalents as a key audit matter – i.e., an area of significant risk of material misstatement.

Key Audit Matters (“KAMs”) have been required under ISA 701 for fiscal years ending on or after December 15, 2016. Fiscal 2017, therefore, represents the first full year for which KAMs are available. The disclosure of KAMs is meant to increase the usefulness and information provided in the auditor’s opinion. The disclosures made by the auditor are supposed to describe the area of significant audit risk, a summary of the auditor’s procedures to test the audit area, and any key observations of the auditor with respect to that risk (where appropriate).

Predominantly, the most common KAMs are the usual suspects: Goodwill Impairment and Investment Valuation (Fair Value). It is highly unusual to see Cash given as a Key Audit Matter, but our analysts have found a few such examples.

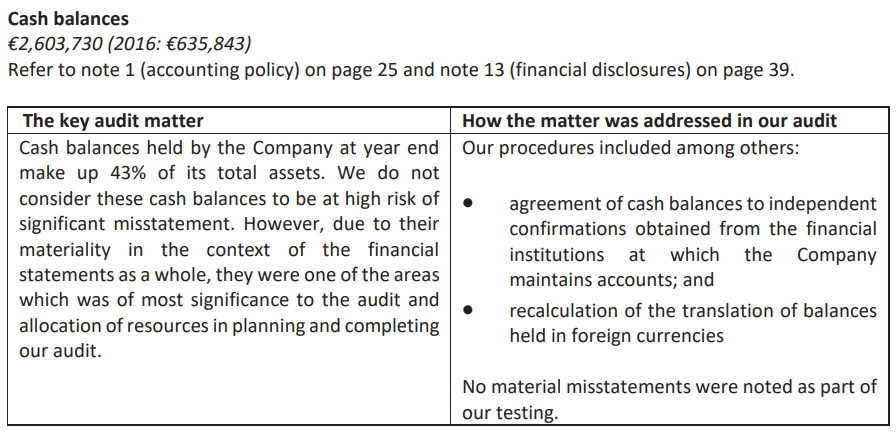

Below we excerpt these cash-related KAMs from the relevant Annual Reports.

argenx SE (ARGX: Euronext Brussels)

2017-12-31 Annual Report

Page 340

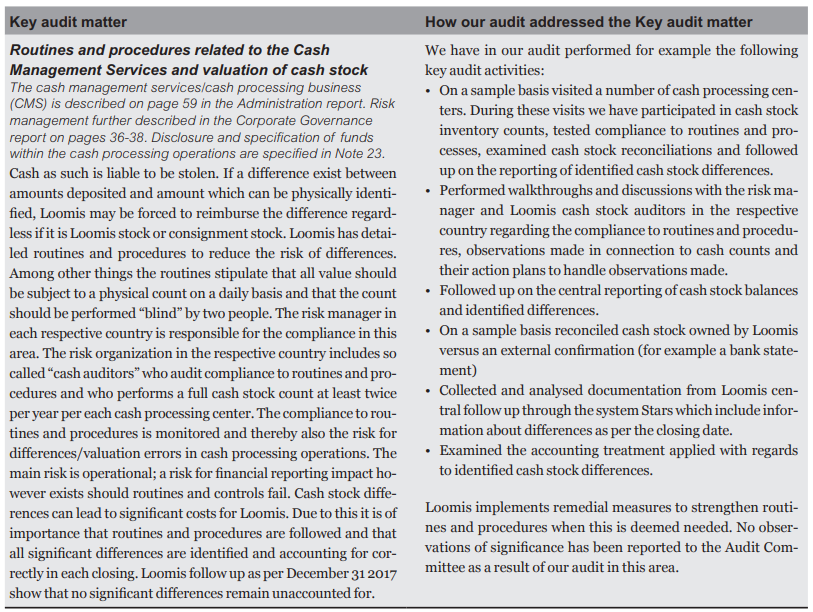

Loomis AB (LOOM B: Nasdaq Stockholm)

2017-12-31 Annual Report

Page 120

In the case of Loomis AB, the KAM related to cash is a little different. Loomis is a cash-handling business – think the armored cars that transport money – and so for them, the cash handling process is definitely a high-risk activity.

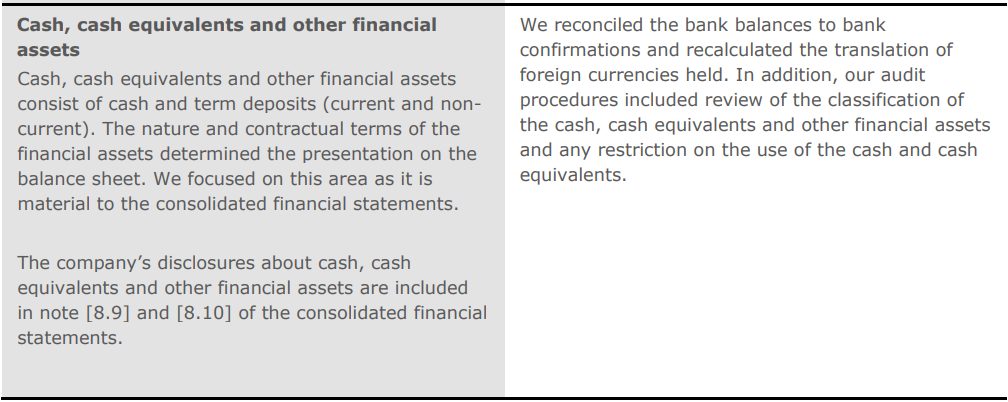

Ablynx NV (acquired)

2017-12-31 Annual Report

Page 105

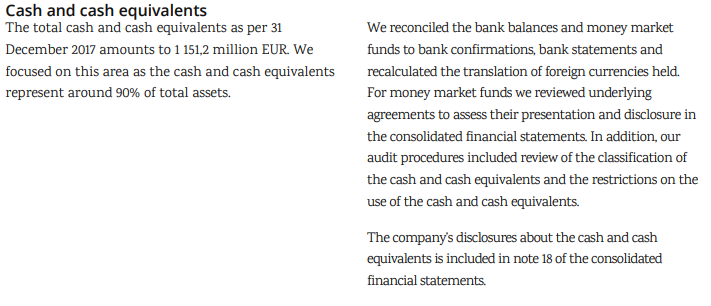

Galapagos NV (GLPG: Euronext Amsterdam)

2017-12-31 Annual Report

Page 140

Great Western Mining Corp PLC (GWMO: London Stock Exchange-AIM)

2017-12-31 Annual Report

Page 19

For more information on this analysis, please contact info@auditanalytics.com.