This analysis was originally posted by Audit Analytics.

Audit Analytics collects all EEA and member-state defined Public Interest Entities (“PIEs”) disclosed by audit firms in annual transparency reports.

Public Interest Entities are:

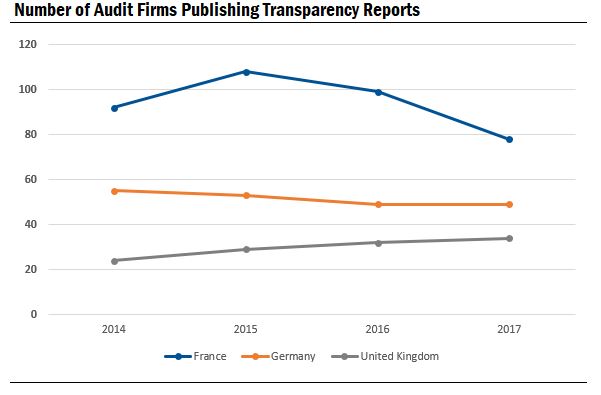

In this post, we look at PIEs disclosed in auditor transparency reports in the UK, France and Germany from 2014-2017. As shown in the chart below, the number of audit firms publishing transparency reports across all three regions peaked in 2015 with 190 reports, decreasing to 161 reports in 2017.

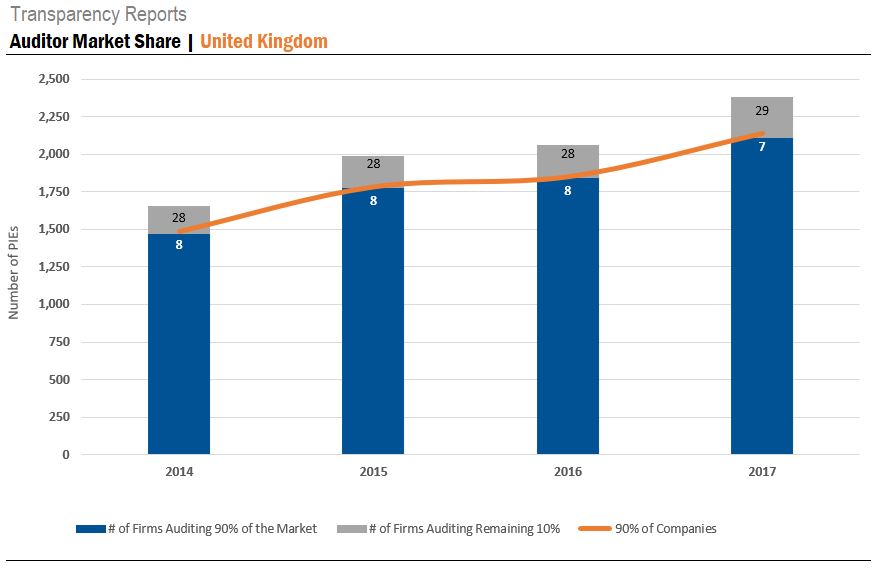

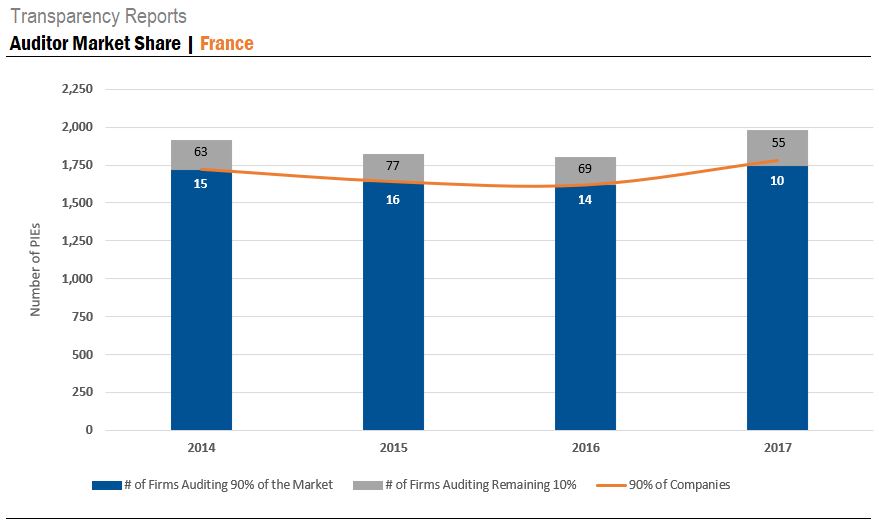

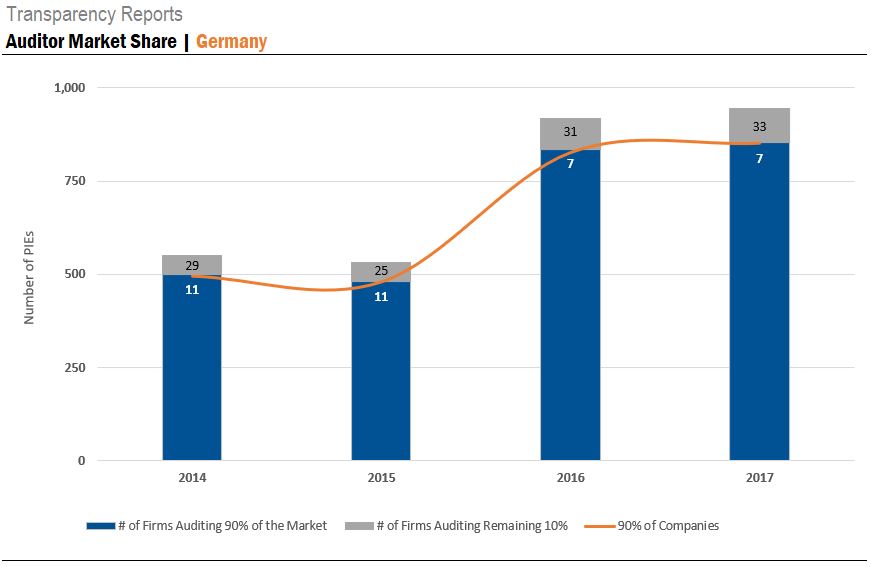

The following charts illustrate auditor market share among audit firms that audit PIEs. As you can see, a limited number of firms are controlling the majority of the market.

In the UK and France, only a small fraction of firms audit 90% of the PIE market. Over the four-year period, the limited number of firms auditing 90% of the market in the UK has remained consistent at eight firms, decreasing slightly in 2017. However, the number of firms auditing the majority of the PIE market in France has been less consistent. In 2017, there were ten firms that audited 90% of the market – the lowest amount in the analyzed period. Similarly, the number of firms that audited the remaining 10% in France changed year-to-year, but remained steady in the UK.

There was a significant increase in PIE disclosures from 2015 to 2016 in Germany, which correlates to the implementation of the 2014 EU Directive. Despite this spike, the number of firms that audited 90% of the market, as well as 10% of the market, were very similar in 2014 and 2015, and also 2016 and 2017. Again, illustrating that a very small number of audit firms consistently audit the majority of the PIE market.

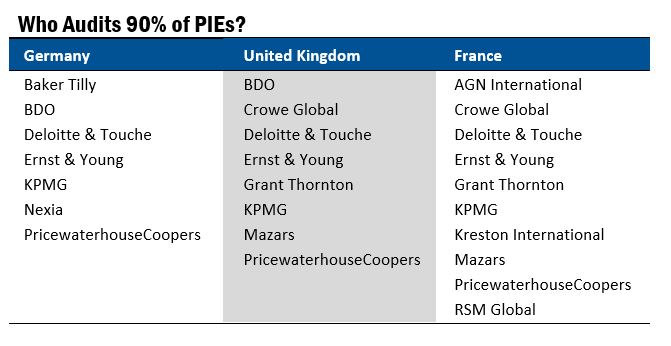

Now let’s look at who’s auditing these PIEs. The table below alphabetically lists the firms that audited 90% of the PIEs in at least three out of the four years examined across Germany, the UK, and France. Unsurprisingly, the Big 4 are present in all three. However, it is interesting to note there are some firms appearing in only one country, including Nexia in Germany and RSM in France.

For more information on this analysis, please contact info@auditanalytics.com.