This analysis was originally posted by Audit Analytics.

The United Kingdom’s pending exit from the European Union has been a cause of extreme uncertainty, both geopolitically and economically. Given the potential magnitude of the event, and considering London’s place as a center of global finance and industry, there is little doubt that Brexit will have a substantial impact on the companies based in the UK and listed on the London Stock Exchange.

These concerns, however, have not yet appeared to surface much in the work of their external auditors, or at least not as frequently as one might have guessed. As of the date of this analysis, auditors of only 138 distinct companies on the London Stock Exchange have referenced Brexit either in a KAM or as a KAM, i.e., a matter that, “in the auditor’s professional judgment, w[as] of most significance in the audit of the financial statements of the current period.”[1] In other words, only about 7% of companies listed on the London Stock Exchange have mentioned Brexit in their KAMs.

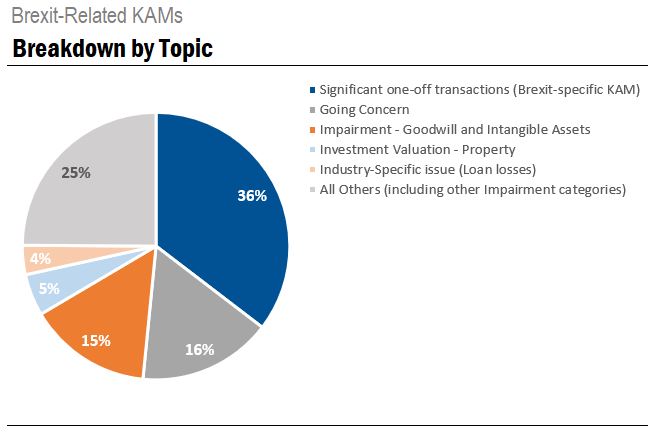

Looking at the normalized topics of Brexit-related KAMs, 70 out of 198 total KAM records, or 35%, specifically report Brexit as the KAM itself, as opposed to just a reference or a factor affecting another KAM. Interestingly, KPMG appears to be the only auditor that specifically cites Brexit as a KAM. Other common Brexit-related KAM topics include going concern (16%) and impairments- goodwill and/or intangible assets (15%).

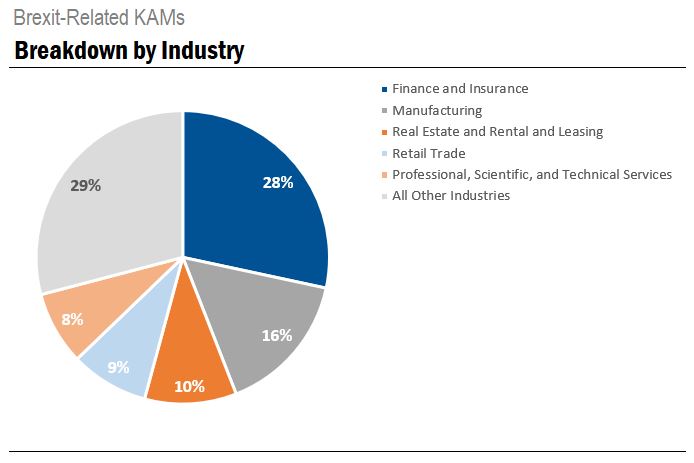

Despite the low numbers to date, what isn’t surprising are the kinds of companies that do have Brexit references in their KAMs. Analyzing NAICS Codes, Finance and Insurance companies appear most concerned regarding the significance of Brexit on the audit, with 28% of Brexit-related KAMs attributed to those industries. This is followed by 16% of Brexit-KAMs relating to the Manufacturing industry, 10% relating to the Real Estate and Rental and Leasing industry, 9% relating to Retail Trade, and 8% to the Professional, Scientific, and Technical Services industry.

This short list includes some big names. Barclays PLC (BARC: LSE), Lloyds Banking Group PLC (LLOY: LSE), and Prudential PLC (PRU: LSE) are among the companies in the Finance and Insurance industry that refer to Brexit in KAMs. Compagnie de Saint-Gobain SA (SGO: EURONEXT – Paris) from the Manufacturing industry, is also on this list.

Of the 70 companies that have specifically cited Brexit as a KAM, 29 are on the FTSE 350. However, only four of those – (Prudential PLC [LSE: PRU], Legal & General Group PLC [LSE: LGEN], Standard Life Aberdeen PLC [LSE: SLA], RSA Insurance Group PLC [LSE: RSA]) – are on the FTSE 100.

As the UK prepares to leave the EU, and as FY 2019 audit opinions continue to roll in, further analysis will illustrate the impact on the number of Brexit-related KAMs, as well as the auditors’ views on how the separation will affect the audit.

For more information on this analysis, please contact us at info@auditanalytics.com.

[1] Across the EU to date, Brexit is only mentioned by 145 distinct companies with equity listed on an EEA or Swiss Exchange; 138 of those distinct companies are on the LSE.