This analysis was originally posted by Audit Analytics.

Accountancy Europe has performed its second annual survey on the auditor’s reporting of key audit matters (KAMs) in the European banking sector since KAMs became required by EU law and international standards in 2017.

One of the main goals of the survey is to benchmark and compare the data from the banking sector, year-over-year. The survey, which highlights over 60 banks that own the vast majority of assets in the European banking sector, focuses on the average number and main topics of KAMs that were reported during the year. More specifically, it takes a deeper dive into the reasons for communicating KAMs and some of the challenges that arise during this process.

In addition, the survey looks at the clarity and presentation of the KAM disclosures. In a year-over-year analysis of the 62 audit reports within the sector, there was a slight decrease in the average number of KAMs per report between 2017 and 2018, from 4.4 to 4.2, respectively.

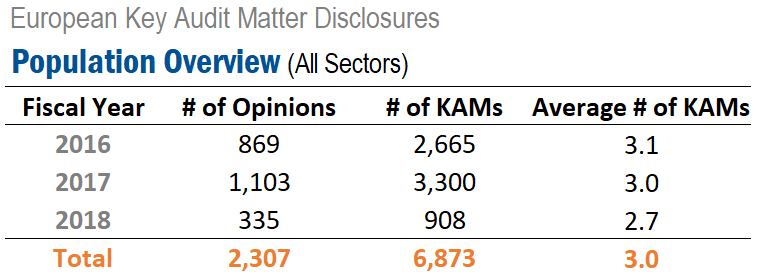

These averages are much higher in comparison to the average number of KAMs across all industries. As cited in the survey, Audit Analytics found an average of 2.7 KAMs in 2018 for all industries; excluding the banking sector resulted in an average of 2.6 KAMs per audit report.

The top three recurring KAM topics were impairment of loan and receivables, classification of financial instruments, and issues related to IT systems – appearing in 92%, 56%, and 50% of audit reports, respectively. In the previous year’s report, KAMs related to IT systems were the second most referenced topic, appearing in 61% of audit reports. The importance of IT systems in the banking industry is underscored by its frequent appearance in KAM topics.

The survey also looked at how often the KAMs were cross-referenced with the financial statements.

The results show the majority of KAMs were linked to the notes to the financial statements. There are certain topics that do not directly relate to financial statement disclosures, and therefore a cross-reference is not applicable. The survey found that KAMs without a cross-reference frequently relate to IT systems due to the general and indirect financial nature of the topic. If an auditor deems that a topic, such as IT systems, is a significant audit risk, an auditor can include a KAM on the topic, even if it is not discussed in the financial statements.

In conclusion, the survey found similar observations as the previous year. The average number of KAMs among the banking sector decreased slightly, but were still significantly higher than the average across all industries. The main recurring KAMs were unsurprisingly related to financial instruments, considering the new standard IFRS 9 “Financial Instruments” became effective as of January 1st, 2018.

Looking at data collected across all industries, asset impairment and recoverability and valuation of investments were two of the three most common KAM topics. Revenue and other income was stated as the second most used classification.

KAMs are generally presented in a clear manner with plenty of notes to the financial statements that support the auditor’s findings. Reporting on KAMs is becoming increasingly helpful to stakeholders and the investor community, as it sheds new light on what the auditor is looking at and provides relevant insights into the company – improving overall confidence in the audit process.

Audit Analytics tracks Key Audit Matters for auditors of EEA and Swiss equity listed entities, normalizes the topic of the KAM, pulls the text of the title and description of the KAM, as well as the auditor’s response.

For more information on our KAMs database, or any of our European databases, please email us at info@auditanalytics.com.