This analysis was originally posted by Audit Analytics.

A going concern modification is the expressed uncertainty that a company is unable to continue in the near future. Generally speaking, this uncertainty relates to whether the company will exist for another 12 months.

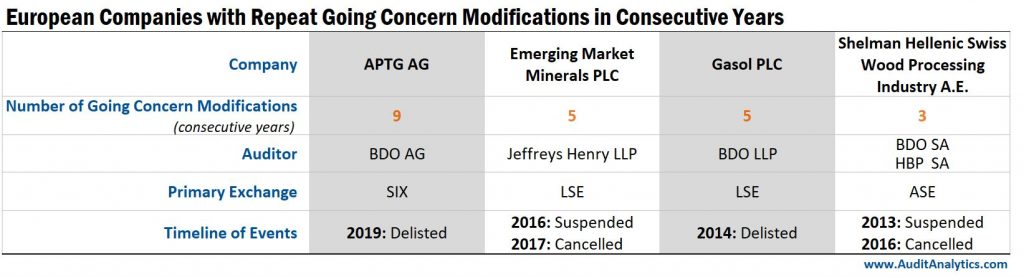

Audit Analytics recently started collecting going concern modifications in the Europe Audit Opinions database. As of today, we have identified more than 170 going concern modifications from the opinions of over 100 companies. Several of these companies presented going concerns over multiple years, which occasionally led to a suspension of trading or a cancellation in shares.

So far, we have identified going concern modifications from 30 companies with fiscal years ending on or after January 1, 2019. Of these companies, Salt Lake Potash Ltd [LSE: SO4] had a going concern in both 2018 and 2019. ITM Power PLC [LSE: ITM] had a going concern in 2017 and 2019 but, interestingly, not in 2018.

Amidst increasing scrutiny of the UK’s accounting and audit sector, more attention has recently been given to going concern modifications in financial statements. In September 2019, the UK Financial Reporting Council revised ISA UK 570, the standard governing the definition of a going concern. The new standard requires auditors to more robustly challenge the going concern assessment made by management, evaluate risk of management bias, and test the supporting evidence.

The changes come after the collapse of several large UK companies – including Carillion PLC and Patisserie Holdings PLC – despite the companies receiving “clean” audit opinions that did not issue a going concern modification or express material uncertainty about the ability to continue as a going concern. Going forward, it will be interesting to see what effect, if any, this revised standard will have on going concern modifications in audit opinions for UK companies.

Although at this point we have limited data on going concern modifications in Europe, we can look to U.S. data for some telling trends. As reported in a recent post, since 2008, the frequency of going concern modifications in SEC filings has continued to fall from a high of 21% to just 13% in 2018. However, while the number of going concern modifications is important, the accuracy of them is even more significant.

Over 20% of large US companies that receive an initial going concern modification file for bankruptcy within the 12 months following the opinion. This is compared to 0.15% of large companies that file for bankruptcy without receiving a going concern modification, suggesting that going concern modifications are fairly accurate.

As we continue to expand our datasets, we are looking forward to following and identifying the trends of going concern modifications in Europe.

This analysis was performed using the Europe Audit Opinions database, powered by Audit Analytics.

For more information on this post, or for access to the database, please email info@auditanalytics.com