This was originally posted by Audit Analytics.

On November 5, 2019, UK’s Financial Reporting Council (FRC) released its Developments in Audit 2019 survey to highlight the Council’s audit monitoring and enforcement results for the previous year. Included in the report are some observations on the current audit market in the UK, focusing predominantly on the FTSE 350.

At a high level, the FRC reports that audit quality is not reaching the high standards expected, as the inspection results of the seven largest firms were unsatisfactory.

Shortcomings were found in the sufficiency of challenge of management.

“This is most prevalent when auditors are evaluating management’s estimates in areas of judgement, where information is often hard to assess but can be highly material to the financial statements.”

Other noted shortcomings involve routine audit procedures, such as the auditing of revenue and long-term contracts.

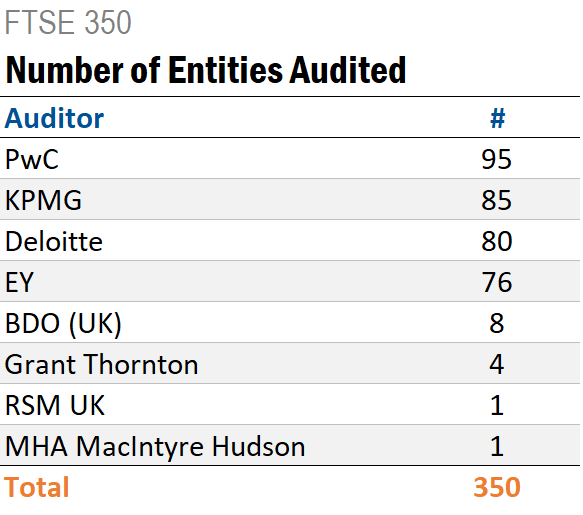

Using data provided by Audit Analytics, the FRC presents observations on the current audit market — noting the high concentration, especially among the FTSE 350.

As shown in the table below, 96% of the FTSE 350 are audited by Big 4 firms.1

Regulations related to auditor rotation have reduced auditor tenure, though, for the most part, resulted in Big 4 to Big 4 movement; only seven companies moved from a Big 4 firm to a mid-tier or small firm since 2012.

The report also noted that since 2014, there has been a 9% increase in audit fees among current FTSE 350 companies, stating “non-audit fees continue to be the main source of income for audit firms”.

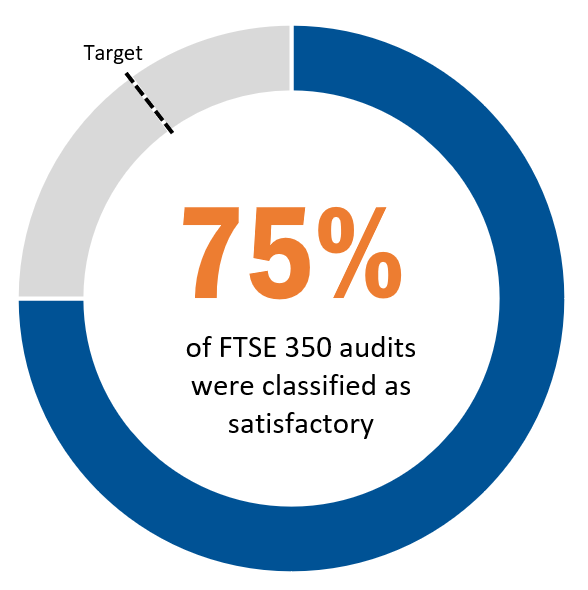

The FRC has increased the number of audit firms it monitors every year. Since 2012, the number of inspections increased 27%, from 126 to 160 audits in 2019.

Inspections assess the following areas:

Findings from the the inspections are categorized as:

Among the auditors of the FTSE 350, Deloitte was the only firm to meet the 90% ‘good or limited improvement’ audit goal in 2019. Of the Big 4, PwC ranked fourth with just 65% of audits inspected classified as good or limited improvements required.

In this review cycle, financial sanctions totaled £42.2 million, compared to £15.2m million in 2017/2018.

Beyond financial consequences, Grant Thornton has been placed under increased scrutiny following significant poor inspection results. PwC, Deloitte, and KPMG have all implemented various actions or training plans for improvement, which are being monitored by the FRC.

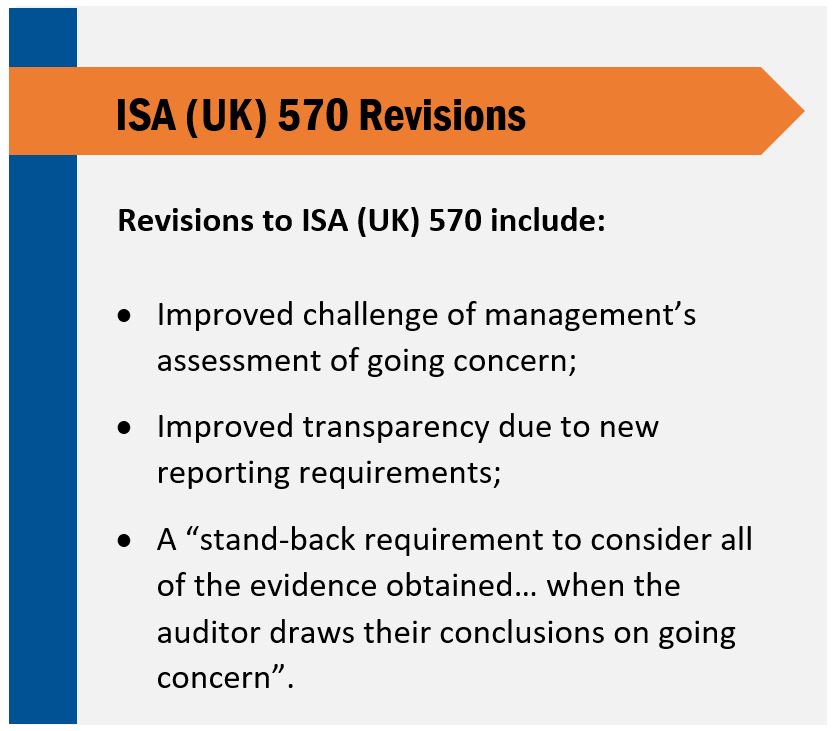

The FRC also cited both national and international efforts to improve audit quality. Notably, ISA (UK) 570 was revised to require stronger scrutiny of auditors’ assessments of going concern; the regulator is hopeful these efforts will spread to the global audit market, as well.

The FRC is working with international standards boards such as International Auditing and Assurance Standards Board (IAASB), the International Ethics Standards Board for Accountants (IESBA), and the International Federation of Independent Audit Regulators (IFIAR) to improve audit quality globally.

Understandably so, the impact of EU Exit on the audit market was noted. With a “no-deal” exit, UK audit firms will immediately cease to be EEA auditors, making them third-country auditors that are required to comply with each member state’s regulations. Conversely, audit firms in EEA member states that audit listed entities in the UK will have to comply with strict UK regulatory framework. Currently there are 70 EEA audit firms that audit 290 EEA issuers in the UK.

In addition, without an agreement following the Exit, UK and Irish auditors will no longer have the reciprocal arrangement to audit in each other’s country. UK auditors will become third-country auditors and be forced to pass an aptitude test and register in Ireland. However, a Memorandum of Understanding between FRC and IAASA (Ireland’s competent authority) is being prepared which may eliminate these difficulties.

Although audits are not consistently reaching the expected high standards, the FRC understands the need to provide confidence in financial reporting.

“The FRC has, and continues to, input into the other three independent reviews, namely the Competition and Markets Authority’s formal market study, the Brydon and the Redmond reviews. Meanwhile, we continue to maintain our focus on audit quality and are taking strong measures to improve it through our monitoring, supervision, enforcement and policy functions.”

Beyond this inspection cycle, it is important to note that the FRC itself will soon be replaced by a new statutory body, the Audit, Reporting and Governance Authority (ARGA). ARGA will have “a new mandate, enhanced powers and accountability to Parliament.”

The analysis in this post was performed using the Europe Auditor Engagement database, powered by Audit Analytics.

For more information on this post, or for access to the database, please email info@auditanalytics.com.

1. This analysis was performed using data as of December 6, 2019; FRC’s survey used data through August 30, 2019.