This analysis was originally posted by Audit Analytics.

In this post, we’ll look at the trends of auditor changes and fees from a selection of European stock indices, specifically the AEX 25, ATX 20, BEL 20, DAX 30, FTSE MIB, IBEX 35, LUX 10, PSI 20, and WIG 20.

There were 159 auditor changes recorded from this sample of indices since 2011; 11 of these changes are still pending confirmation from a company’s signed audit opinion.

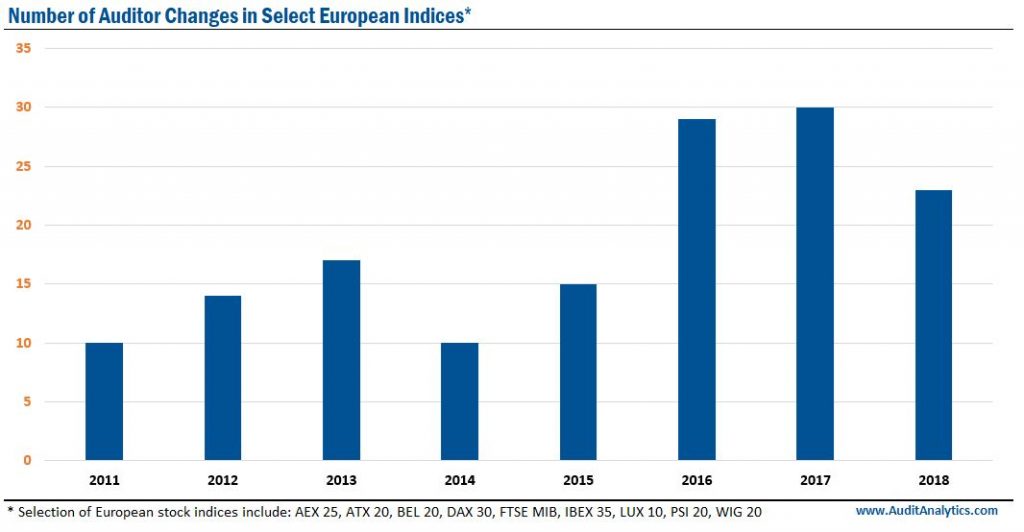

Effective since mid-2016, Directive 2014/56/EU, together with Regulation 537/2014, mandates that auditor tenure for public interest entities (PIEs) be limited to ten years, though the same audit firm can be appointed for another 14 years in the case of joint audits. With mandatory auditor rotation effective in 2016, we saw an increase in the number of auditor changes reported.

As illustrated in the chart above, 2016 and 2017 saw the highest number of auditor changes in the years analyzed, however, auditor change activity slowed in 2018.

In 2015, there were a few companies that saw significant decreases in their audit and audit related fees; Argenx SE dropped from €283,000 (paid to PwC) in 2014, to €105,000 (paid to Deloitte) in 2015. Argenx started as a private company with limited liability and was, prior to the completion of the IPO, converted to a Dutch public company. The shares began trading on the Euronext Brussels exchange on July 10, 2014, under the symbol [ARGX], so it’s possible that the extra costs from the IPO contributed to the higher fees.

Banca Generali also saw a huge decrease in audit and audit related fees after switching auditors, with fees going from €360,000 (EY) in 2014 to €79,000 (BDO) in 2015. It is interesting to note that the fees paid to BDO in 2016 increased to €356,000.

The chart below highlights a few of the auditor changes among some of the largest companies (by market cap) of each respective index, as well as the total fees from the years both before and after the change occurred.

Royal Dutch Shell PLC, the largest company on the AEX 25, saw a slight increase in total fees after switching from PwC to EY. This auditor change arose from a standard tender process with EY being selected as auditor.

On the other hand, PKO Bank Polski SA of the WIG20 saw a large decrease in total fees after switching from PwC to KPMG. Although they switched auditors in 2015, they still paid almost €240,000 in audit related fees to the old auditor, PwC.

The summary below displays the total wins and losses from the Big Four and other audit firms over the sample from 2011-2019.

Summary of Changes:

EY accounted for the most new clients during this time, with a net total of 19 new clients.

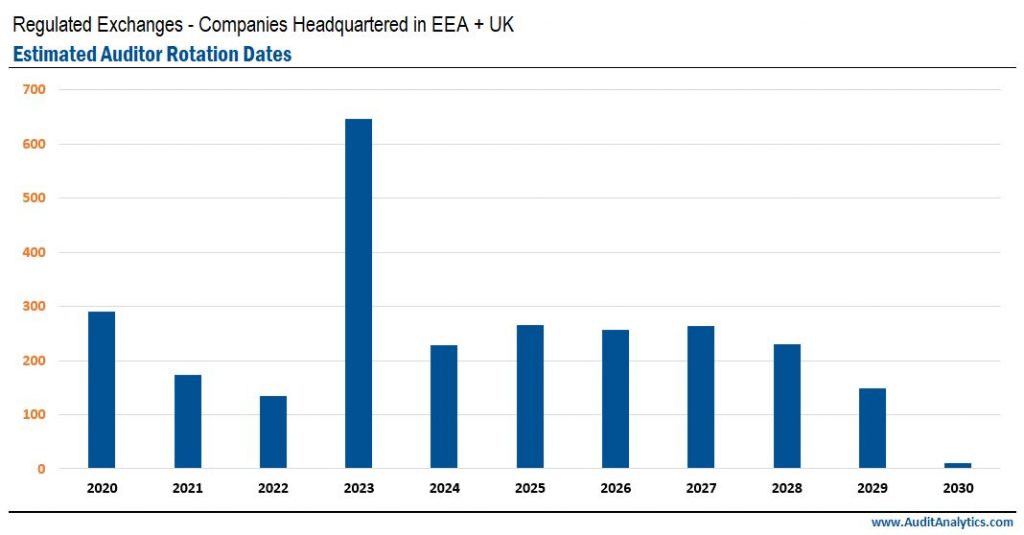

In the coming years, we expect similar auditor change trends – with 2019 through 2022 dipping down slightly with a big influx of changes coming in 2023, as illustrated in the chart below.

The Audit Analytics Europe Auditor Changes database currently contains over 4,500 auditor changes of nearly 3,500 companies, though this number will continue to grow as the filings of companies with fiscal years ending December 31, 2019 are released and as the database backfill is completed.1

The analysis in this post was powered by the Audit Analytics Europe Auditor Changes database.

For more information on any of these European databases, or to request a demo, please contact us.

1. Audit Analytics is currently collecting Europe Auditor Changes dating back to 2010. We expect this data to be complete by April 2020.