This analysis was originally posted by Audit Analytics.

The uncertainty caused by COVID-19 is causing companies in Europe to reevaluate their ability to continue as a going concern.

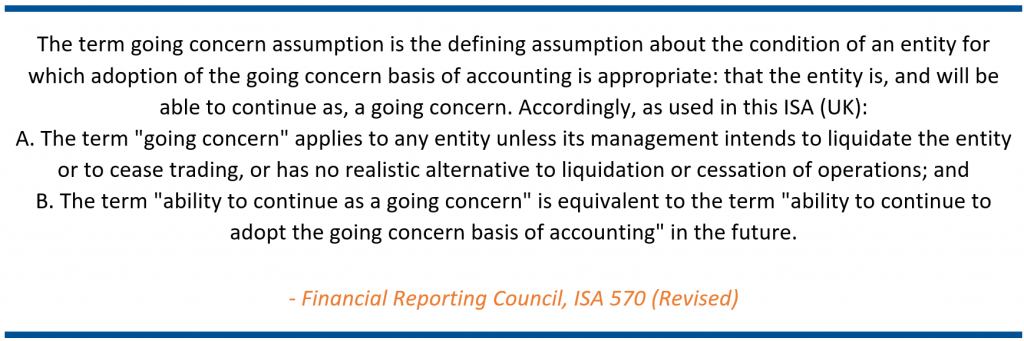

A going concern modification is the expressed uncertainty that a company is unable to continue in the near future. Generally speaking, this uncertainty relates to whether the company will exist for another 12 months.

The audit opinion of Intu Properties PLC [XLON:INTU], a UK based real estate investment trust (REIT), referenced COVID-19 as part of the Company’s material uncertainty relating to going concern. Covenant compliance and financing are two areas that were highlighted in the opinion as areas of focus for the Company’s ability to continue as a going concern. The opinion explained that a decline in property valuations and rental income could result in the breach of certain covenants and reduce the Company’s ability to refinance its borrowings.

Intu’s financial statement footnotes explained that a 10% decline in property value would result in a £113.0 million covenant cure and a £161.0 repayment of the Company’s net borrowing facility. Alternatively, a 10% decline in net rental income would result in a £34.0 million covenant cure.

While management has a plan that involves “alternative capital structures and further disposals to provide liquidity” that would allow them to reduce net external debt and refinance borrowing, COVID-19 has introduced additional uncertainty to the Company’s outlook.

The audit opinion of Beter Bed Holding [XAMS:BBED], a Netherlands based furniture retailer, noted that “the Group’s business operations may be severely impacted by the COVID-19 (Corona) virus.” Beter Bed Holding had worked to improve its position by stabilizing operating cash flows and divesting from the Company’s Matratzen Concord operations. But management identified in its financial statement footnotes “increased uncertainties following the COVID-19 worldwide outbreak” and an “initial decline in consumer traffic” as of March 14, 2020, as reasons to doubt the company’s ability to continue as a going concern.

Beter Bed’s CEO noted in his statement that “consumers might become less confident due to the current macroeconomic and political volatility especially now the impact of the COVID-19 virus on the global economy provides increased uncertainty.”

It appears that Intu Properties PLC would have received the going concern opinion regardless of the COVID-19 pandemic; however, Beter Bed Holding may not have received a going concern opinion had it not been for the COVID-19 pandemic. These two examples may preview what we can expect to see as more companies issue their financial statements.

This pandemic is likely to exacerbate the issue for companies already facing financial hardship and present additional challenges to companies in certain industries – like consumer discretionary goods, food and services, and the travel industry. We expect to see more going concern opinions due to the uncertainty cause by COVID-19.

This analysis was performed using the Europe Audit Opinions database, powered by Audit Analytics.

For more information on this post or to request a demo, please contact us.