This analysis was originally posted by Audit Analytics.

On Tuesday, March 31, Quixant PLC – a UK-based gaming technology company – issued the following statement, claiming that KPMG LLP (UK) has decided to not sign any audit opinions or consents until April 5th:

Quixant (AIM: QXT), a leading provider of innovative, highly engineered technology products principally for the global gaming and broadcast industries, today provides highlights of its unaudited financial results for the year ended 31 December 2019 and a trading update in light of COVID-19. As announced on the 27 March the full audited results have been delayed until 6 April, due to the Group’s auditors, KPMG LLP, decision not to sign any audit opinions or consents until 5th April 2020. The Group does not expect any deviation from these published figures once the audited results are announced.

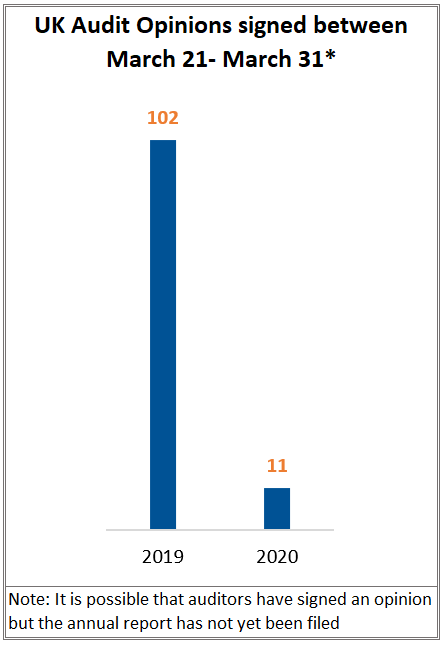

Although we haven’t been able to confirm that KPMG, specifically, is not signing any audit opinions until April 5th, we can say we have only seen 11 UK opinions signed since the FCA issued its moratorium on March 21st.1 For comparison purposes, there were 102 opinions signed by UK audit firms during the same time frame last year. That said, KPMG may not be alone in holding off on audit opinions.

On March 24, Bloomberg Tax reported that three of the Big Four audit firms are supporting the U.K. regulators’ calls for delaying financial reporting of large companies, as the coronavirus pandemic wreaks havoc on businesses across the world.

As previously reported, on March 21, the Financial Conduct Authority (FCA) requested that companies delay publishing their previously scheduled preliminary results for two weeks. The main intention of the voluntary moratorium is to allow companies to fully address and disclose the challenges they are facing as a result of COVID-19. The impacts of this pandemic have been developing rapidly, and delaying results may allow companies better footing to fully disclose the expected impact, in addition to allowing companies and audit professionals more time. Interestingly, the FCA moratorium was on preliminary results, not the actual annual reports.

According to the Bloomberg Tax article, Jon Holt, KPMG LLP’s UK audit head, stated, “it is clear that given the pressures on people and the changes that we see day to day, it is in the public interest for reporting to be delayed.”

The Wall Street Journal (WSJ) also reported similar findings in an article published on March 26, explaining that the changes are welcomed by the Big Four. Afterall, both auditors and companies are facing many hurdles during these unprecedented times, so any and all relief seems to be embraced.

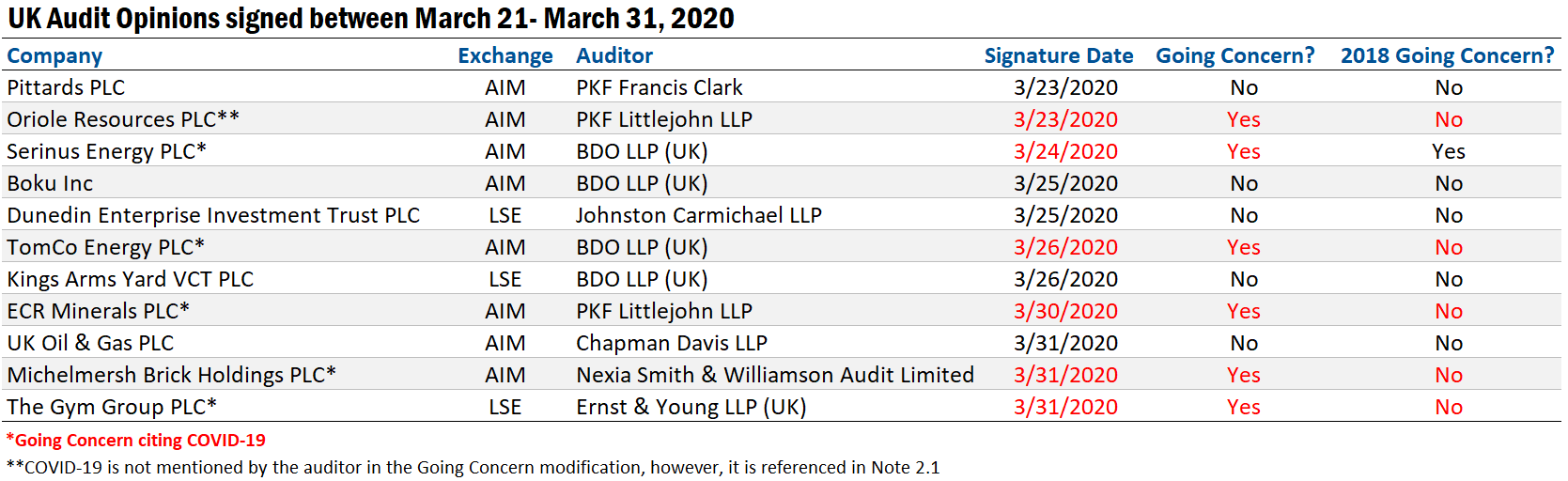

As for the 11 opinions we’ve seen since the moratorium, only one was signed by a Big Four firm:

Of these opinions, six have going concerns, and the auditors for five of those opinions explicitly cited COVID-19. Worth noting is that eight of the opinions are for companies traded on AIM, which was excluded from the moratorium provisions. Considering the purpose of the delay – which is to allow companies to fully address and disclose the challenges they are facing as a result of the coronavirus – let’s take a look at what these companies are disclosing as far as uncertainties go.

Serinus Energy

The audit opinion of Serinus Energy [AIM: SENX], an oil and gas service company, referenced COVID-19 as part of the Company’s material uncertainty relating to going concern. Covenant compliance, financing, and the potential impact of COVID-19 are topics that were highlighted in the opinion as areas of focus for the Company’s ability to continue as a going concern.

Material uncertainty related to going concern

We draw attention to Note 2 of the financial statements concerning the Group’s ability to continue as a going concern. The matters explained in Note 2 relating to the potential non compliance with loan covenants, the sensitivity of cashflows required to continue to provide the Group with the ability to meet its obligations as they fall due and the potential impact of COVID-19 on the Company and the international markets indicate the existence of a material uncertainty which may cast significant doubt over the Group’s ability to continue as a going concern. These financial statements do not include the adjustments that would result if the Group was unable to continue as a going concern. Our opinion is not modified in respect of this matter.

However, it’s important to note that Serinus has had a going concern since 2015, related to debt covenant obligations and cash flow from operations. So, while COVID-19 may very much be a driving factor, it’s most likely not the root of its most recent going concern.

TomCo Energy

The audit opinion of TomCo Energy [AIM: TOM], a petroleum and natural gas company, referenced COVID-19 as part of the Company’s material uncertainty related to going concern. Looking at the Company’s cash flow, forecasts indicate it will need further funding in order to meet liabilities. Given the uncertainty surrounding the impacts of COVID-19, which could cause delays and hinder the ability to raise further funds, it’s apparent the pandemic plays a large role in this going concern.

Material uncertainty in relation to going concern

We draw attention to the disclosures made in Note 1.1 to the financial statements concerning the Group’s ability to continue as a going concern. The Group’s cash flow forecasts indicate that the group will need further funding in order to meet its liabilities as they fall due until March 2021 and to continue as a going concern. In addition to this, the Group have noted further uncertainty created by the COVID-19 pandemic which could impact the ability the raise further funds and cause delays to the project. These conditions indicate the existence of a material uncertainty which may cast significant doubt about the Group’s ability to continue as a going concern. Our opinion is not modified in respect of this matter

Worth noting: this is the first going concern for TomCo Energy.

ECR Minerals

The audit opinion of ECR Minerals [AIM: ECR], a mining company, referenced COVID-19 as part of the Company’s material uncertainty relating to going concern due to impacts to overall operations and the ability to raise equity funds.

Material uncertainty related to going concern

We draw attention to note 2 in the financial statements, which indicates that the Group’s ability to meet contracted and committed expenditure for the 12 months from the date of approval of the financial statements is reliant on further fundraising and additional cash inflows from the planned sale of assets. The total comprehensive loss for the Group during 2019 was £757,210, with cash outflows of £507,250, and a year-end cash balance in the Group of £268,517. The Group will require further funding within a period of 12 months from the date of approval of the 2019 financial statements in order to avoid a cash deficit, which is not yet committed. In addition, the potential impact of COVID-19, whilst not yet fully understood, will likely have an impact on the operations of the business and the ability to raise additional equity funds. As stated in note 2, these events or conditions, along with the other matters as set forth in the Chairman’s statement in relation to COVID-19, indicate that a material uncertainty exists that may cast significant doubt on the Group’s and Company’s ability to continue as a going concern. Our opinion is not modified in respect of this matter.

This is also the first going concern for ECR Minerals.

The audit opinion of Michelmersh Brick Holdings [AIM: MBH], a manufacturer of clay bricks, tiles and pavers, referenced COVID-19 as part of the Company’s material uncertainty relating to going concern.

Material uncertainty related to going concern

We draw attention to the accounting policy in the financial statements concerning the group’s ability to continue as a going concern. On 11 March 2020, COVID-19 was declared a pandemic by the World Health Organisation. The impact of the COVID-19 pandemic on the business remains unquantifiable at this stage, particularly in relation to implications for the construction industry and wider economy. These conditions indicate the existence of a material uncertainty which may cast significant doubt upon the group’s ability to continue as a going concern. Our opinion is not modified in respect of this matter.

This is the first going concern for the Company. Despite the going concern, Michelmersh’s 2019 Annual Report asserts that there is a reasonable expectation that the Company has adequate resources to continue in operational existence for the foreseeable future, but recognize that the impacts of the COVID-19 pandemic on the construction industry and wider economy are difficult to predict at this time.

The Gym Group

The audit opinion of The Gym Group [LSE: GYM], a physical fitness facility, referenced COVID-19 as part of the Company’s material uncertainty relating to going concern.

Material Uncertainty Related to Going Concern

We draw attention to note 2 to the financial statements which indicates that the ability of the Group and Company to continue as a going concern is subject to material uncertainty. With the current outbreak of Covid-19 in the UK, the Group has had to temporarily close all of its sites as a result of enforcement action by the UK Government, and there is uncertainty over the length of the required closed period and the potential reductions in revenues resulting from changes in the behaviours of members once gyms are allowed to open As stated in note 2, these events or conditions, along with other matters as set forth in note 2, indicates that a material uncertainty exists that may cast significant doubt on the group and company’s ability to continue as a going concern. Our opinion is not modified in respect of this matter.

…

We draw attention to the Viability statement in the Annual Report at page 45 which indicates that an assumption to the statement of viability statement in respect of going concern in light of the material uncertainty arising as a result of the Covid-19 outbreak. Our opinion is not modified in respect of this matter.

This is The Gym Group’s first going concern. Given the reasoning, this going concern is undoubtedly related to COVID-19, which forced the Company to temporarily close all of its locations and suspend membership payments.

We recently posted about going concerns triggered by coronavirus impacts, explaining that this pandemic is likely to exacerbate the issue for companies already facing financial hardship and present additional challenges to companies in certain industries – like consumer discretionary goods, food and services, and the travel industry. We expect to see more going concern opinions due to the uncertainty cause by COVID-19, though we’re unsure when they’ll come in.

For more information on this post, or to request a demo of our Europe databases, please contact us.

1. It is important to note that it’s possible an auditor has signed an opinion during this time, though the annual report has not yet been filed.