This analysis was originally posted by Audit Analytics.

The Financial Reporting Council (FRC) is now acting on changes recommended by the recent independent reviews of the audit market in the UK. Deloitte, EY, KPMG, and PwC have each been notified on 6 July 2020 that they have four years to complete the separation of operations between the auditing and the consulting arms of their businesses.

The FRC’s Business Case Paper highlights the main objectives of the regulation as:

Each of the Big Four – after agreeing to the operational separation – must submit a transition timetable, as well as an implementation plan to the FRC by 23 October 2020. The separation itself must then be completed by 30 June 2024.

The FRC will assess each firm’s progress on the objectives and outcomes of the operational separation on an annual basis. These assessments will be published, as the regulatory body emphasizes that it will need to be given “backstop powers” to enforce compliance with this, and with other upcoming audit reform legislation.

The Business Case Paper clarifies that the audit practice can continue to provide:

This concept was first formally recommended in the CMA Report of April 2019 and was further clarified in the Brydon Review published in December 2019. The FRC notes that it has engaged in extensive conversations with the Big Four in order to come up with a workable plan for the changes.

PwC and Deloitte both issued positive formal comments on the changes:

“We share the FRC’s objectives of improved quality and confidence in audit, market resilience and the continued attractiveness of the profession as a career, and are committed to playing our part… The proactive steps we took a year ago to create a distinct Audit practice as part of our Programme to Enhance Audit Quality mean we are already aligned with many of the principles.”

“We welcome this clarity from the FRC on the principles of operational separation and will continue working with them to develop our plans over the coming months. … Deloitte has been consistent in our support for reform. We remain committed to playing our role in delivering change that embraces audit quality, improves choice and restores trust…”

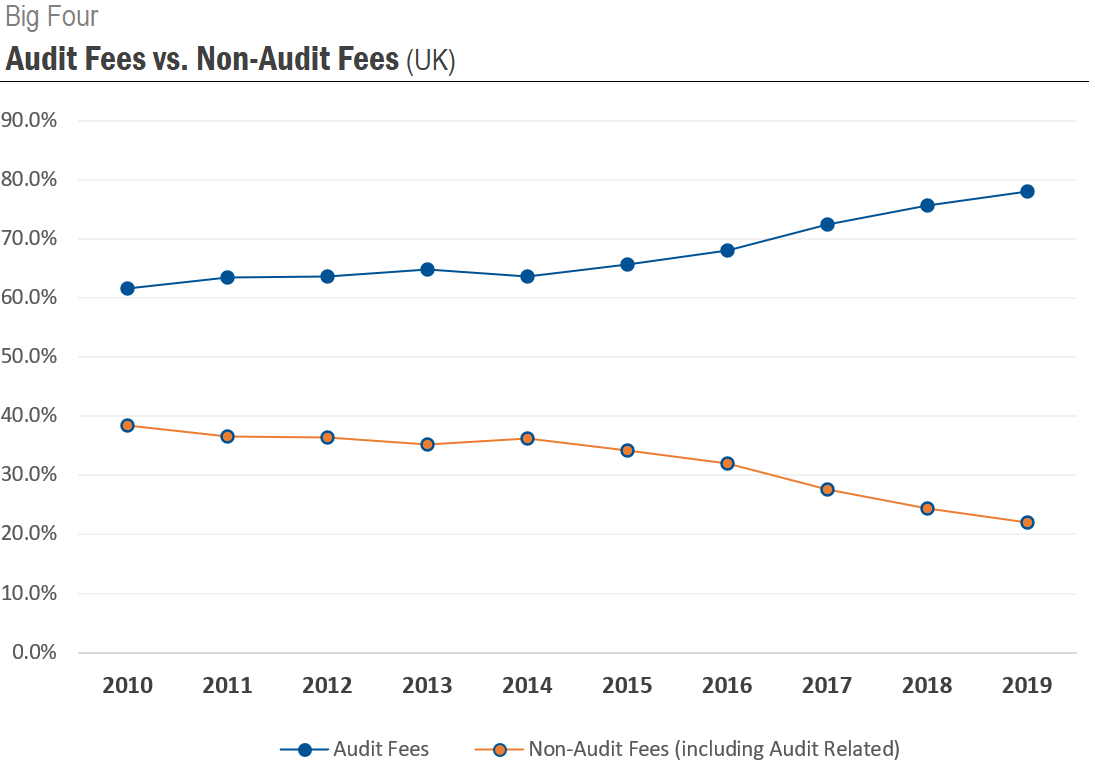

According to our Europe Audit Fees database, non-audit fees in 2019 account for roughly 22% of the fees paid to the Big Four by their publicly listed clients in the UK. In its Revised Ethical Standard of 2016, the FRC made an initial attempt to curb the trend toward excessive provision of non-audit services. As shown in the chart below, since 2016, the percent of non-audit fees has fallen 10% – landing at 22% for 2019.

Further anticipated changes include the formation of a new audit governing body – the Audit, Reporting and Governance Authority (ARGA) – that will replace the FRC. Also under consideration is a requirement for large companies to engage in a dual or joint audit. There are several other, less quantifiable recommendations proposed by Brydon, such as increased auditor skepticism, extension of auditing beyond the financial statements, and increased use of technology.

Now that the government can begin to focus on areas outside of COVID-19, it will be interesting to watch these changes unfold.

For more information on this analysis, please contact us.

Interested in our content? Be sure to subscribe to receive our email notifications.