This analysis was originally posted by Audit Analytics.

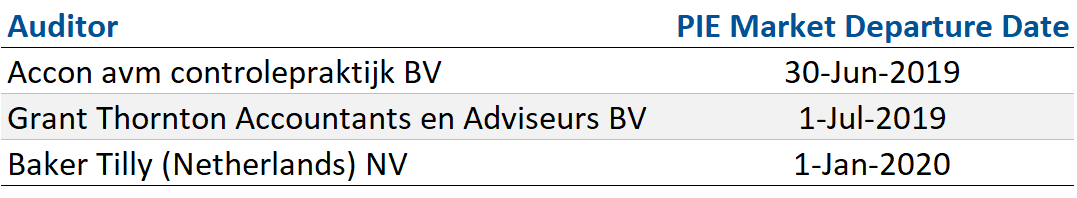

Auditor market share is extremely concentrated in the Netherlands due to the dwindling number of audit firms registered to audit public interest entities (PIEs). In 2018, there were nine audit firms licensed to audit PIEs. However, in the past year, three have chosen to leave the PIE market, leaving both listed and non-listed PIEs searching for new auditors long before the mandatory rotation. Following Regulation (EU) No 537/2014 of the European Parliament, companies in the Netherlands must rotate their auditor every ten years; a three-year cooling off period is also required before a previously engaged auditor may be re-hired.

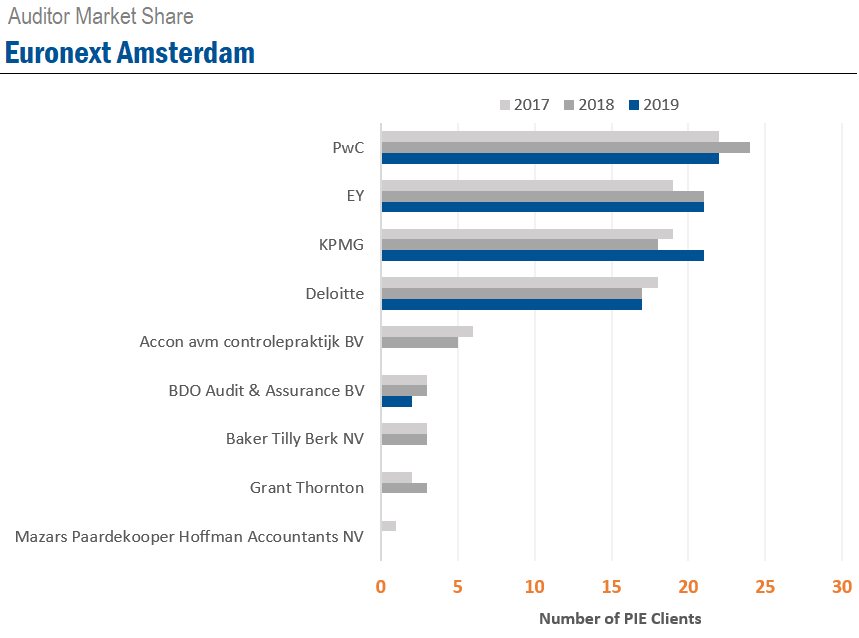

The graph below shows the number of listed PIEs audited by the nine PIE auditors over a three-year period. As you can see, it’s a very top-heavy concentration, as the Big Four controlled the majority of the market even prior to the departure of the three auditors.

So far, the 2019 annual reports show an increase in the number of clients audited by KPMG. However, because several companies have delayed publishing their reports, the current data for 2019 only represents a partial year. We can expect the number audited by the Big Four to continue to grow as these annual reports are published.

Some companies have been unable to obtain a new auditor and have had to postpone publishing their annual reports, while some have resorted to extending their financial year. Value8 NV, a company listed on Euronext Amsterdam, lost Accon after only two years of statutory auditing. In its 2019 annual report Value8 explains:

“Due to the limited number of PIE accountants and the limited available capacity, it proved impossible to attract a new accountant for the current financial year. Value8 received much support from other listed small caps that faced the same problems. On December 27, 2019, Value8 received approval from the General Meeting of Shareholders to extend the financial year to the end of 2020. This has created more time to appoint a PIE accountant for the audit of the 2019/2020 financial statements. Given the circumstances, no alternative was available”1

Similarly, AND International Publishers, also listed on Euronext Amsterdam, is in the same position since Grant Thornton decided to leave the PIE market after auditing the company for just one year. AND International Publishers stated in its 2019 annual report:

“As communicated to the markets by press release on 5 March 2020, AND has been unable to find an OOB-licensed auditor for the Annual Report 2019.2 As a result, the Annual Report was produced by company Management but without the normal audit process. The Supervisory Board has focused on ensuring that the Accounts were drawn up in accordance with all applicable laws and regulations as well as in accordance with past practices, which were audited and approved at the time. Particular attention was given to the impairment test on the company’s intangible assets.”

Why did these auditors relinquish their PIE audit licenses? According to Accon’s 2019 Transparency Report: “Holding a PIE license and properly serving PIE customers has placed disproportionate pressure on capacity and required intensive management attention, while these customers represent a modest share of total sales. A further focus on the PIE segment would therefore be at the expense of the necessary development of the services in which Accon avm is strong. Accon avm will of course continue to perform audit procedures for non-PIE customers in its core sectors.”3

Grant Thornton offered less information in their 2019 Transparency Report: “Our ambition is to occupy an important position in the control of the mid corporate and SME segment. Based on this philosophy, the aim in 2018 to also increase our footprint in the segment of public interest entities (PIE) was reconsidered. This has led us to shift our focus to the customer segment in which we are strong and have therefore decided to convert the PIE license to a non-PIE license.”4

Nevertheless, both firms left a positive note about withdrawing from the market, citing that it allows them to focus on the majority of their clients rather than dedicate so much time to the few PIEs. The impact on listed companies has already been felt and is sure to continue as fewer audit firms in the Netherlands are auditing PIEs.

For more information on this analysis, please contact us.

Interested in our content? Be sure to subscribe to receive our email notifications.

1. Translated from page 17 using Google Translate

2. OOB is PIE in Dutch; Organisaties met een Openbaar Belang-OOB

3. Translated from page 7-8 using Google Translate

4. Translated from page 18 using Google Translate