This analysis was originally posted by Audit Analytics.

Since our last analysis of key audit matters in December 2019, the Audit Analytics KAMs database has grown to include over 40,000 KAMs from the audit opinions of over 4,600 companies.

KAMs, required under ISA 701 for fiscal years ending on or after December 15, 2016, are intended to increase the usefulness and information provided in the auditor’s opinion. The disclosures made by the auditor are supposed to describe an area of significant audit risk, a summary of the auditor’s procedures to test the audit area, and any key observations of the auditor with respect to that risk (where appropriate).

As previously mentioned, many annual reports experienced a delay earlier this year due to the COVID-19 pandemic. In March 2020, the European Securities and Markets Authority (ESMA) encouraged national competent authorities (NCAs) not to take action against listed entities that requested a delay in their filings; meanwhile, some countries offered extensions for these filings.

That said, while the majority of 2019 annual reports have been filed, it is possible that the number of KAMs presented in this analysis will increase as we continue to collect audit opinions as they are published.

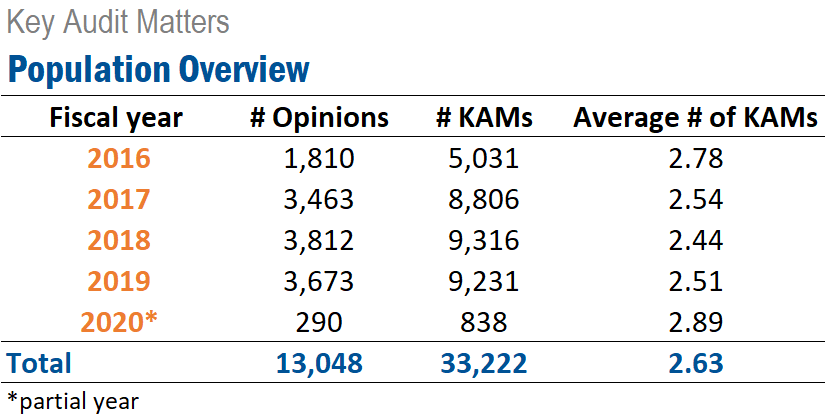

Population Overview

In the past year, Audit Analytics has collected over 10,000 new KAMs. In this post, we’ll focus on KAMs disclosed for fiscal year 2019, as 2020 is not yet complete.

As shown in the table above, the average number of KAMs per report has been trending downward until 2019, where there has been a reversal in the trend. Part of the increase in the number of KAMs collected from 2019 reports can be attributed to nearly 400 KAMs referencing the COVID-19 pandemic.

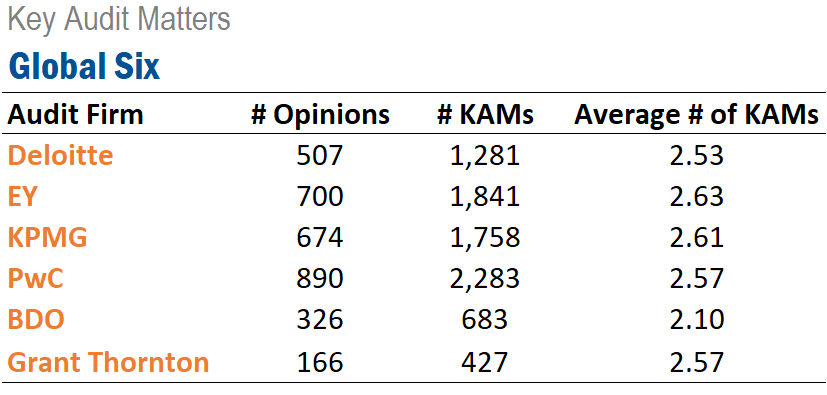

KAMs by Auditor

Overall, the Big Four audit firms were relatively consistent with the number of KAMs per audit report, ranging from 2.53 to 2.63, with EY reporting the most KAMs and Deloitte reporting the least in 2019.

BDO and Grant Thornton both saw an uptick in the number of KAMs per audit report in 2019, climbing from 2.0 and 2.2, respectfully, in 2018.

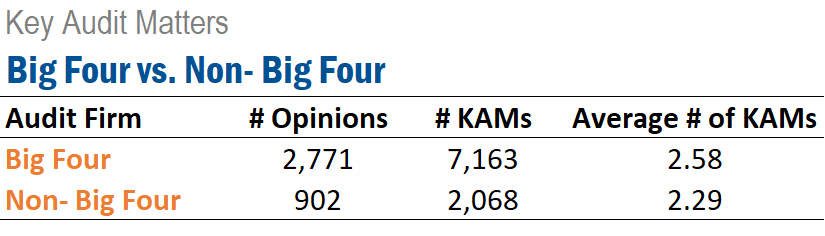

Last year, when looking at Deloitte, EY, KPMG, and PwC versus all other audit firms, we found the Big Four firms report more KAMs per audit opinion, on average. While this is still the case, the gap seems to be closing with non- Big Four firms averaging 2.3 KAMs per report in 2019.

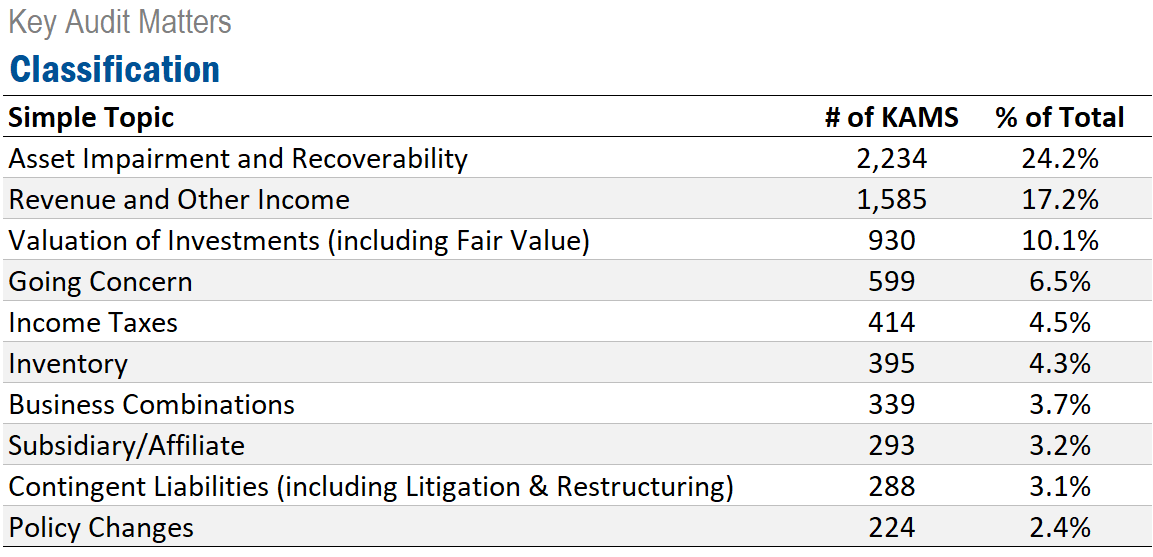

Trends in KAM Topics

Asset Impairment and Recoverability was (again) the most reported KAM in 2019, appearing in just over 24% of audit reports – a slight decrease from 25% in 2018. Revenue and Other Income and Valuation of Investments follow with roughly 17% and 10%, respectively.

Interestingly, KAMs related to Going Concern saw a large increase in 2019, appearing in 6.5% of audit reports – a significant increase from 2.4% in 2018 – and jumping from ninth on the list in 2018 to fourth in 2019. This spike is ostensibly due to the COVID-19 pandemic that has affected companies and businesses worldwide.

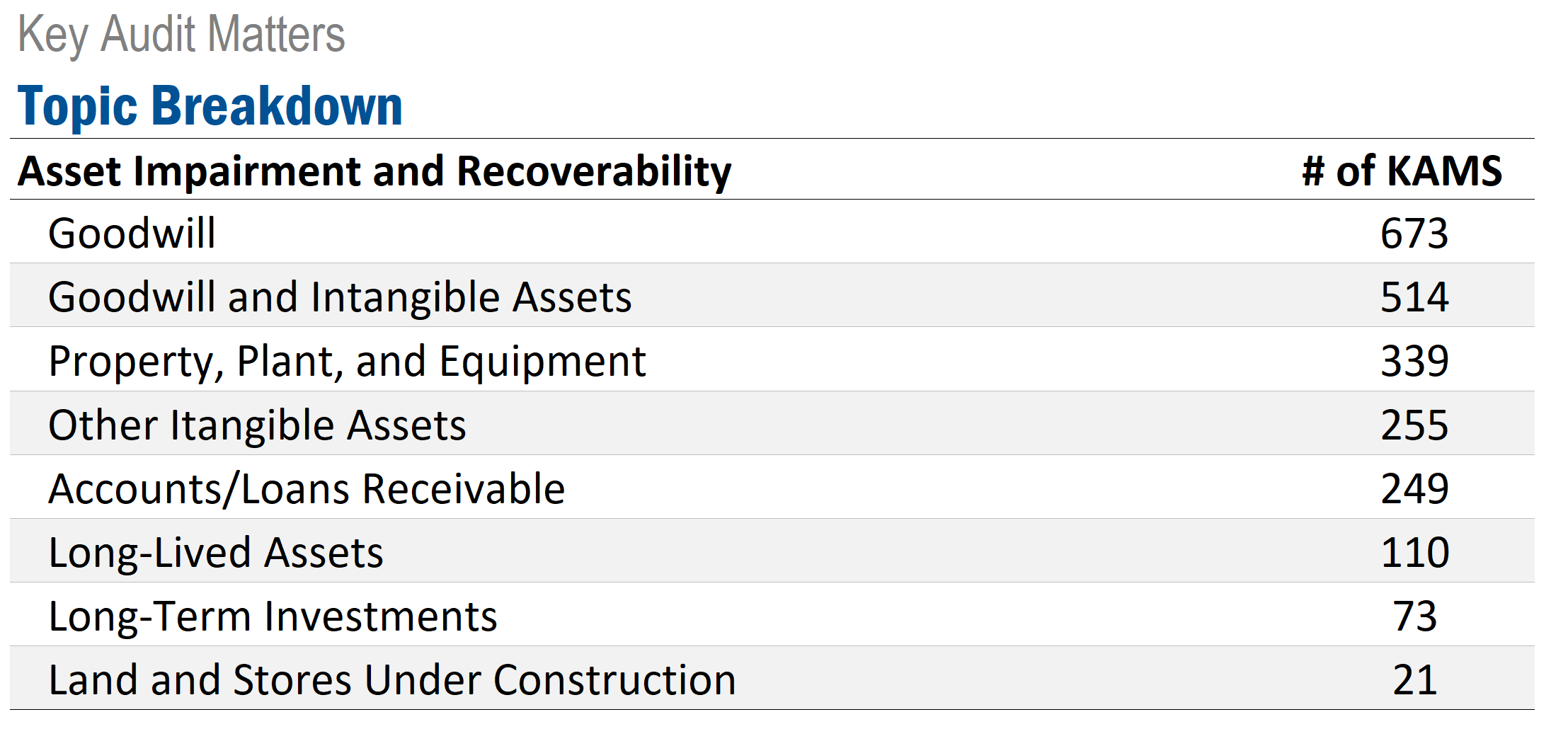

Expanding on the Asset Impairment and Recoverability topic, we see that 15.6% of all KAMs in 2019 are related to impairments of goodwill and other intangible assets.

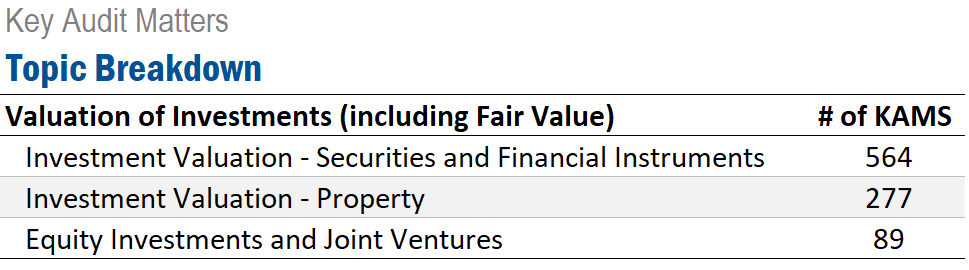

Looking at a more granular breakdown, the table below shows several types of investment valuations that are commonly reported, with securities and financial instruments being the most common. These rankings remain unchanged since our last analysis.

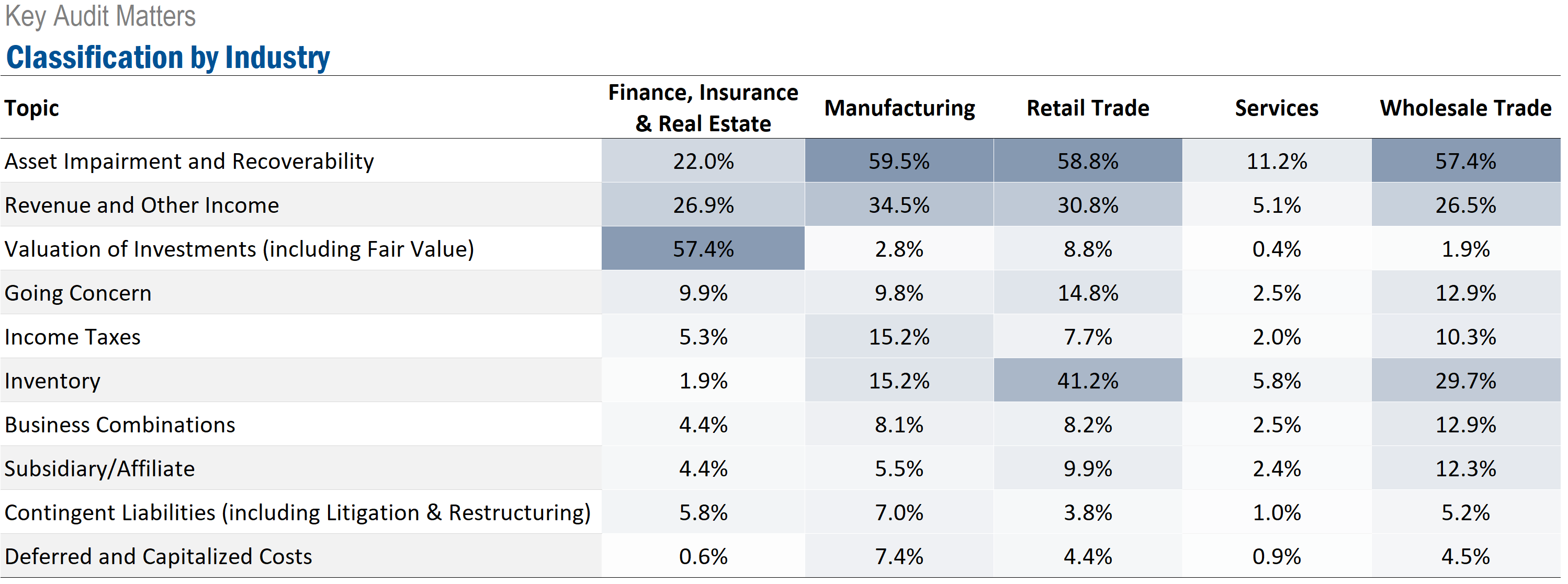

Classification of KAM Topics by Industry

Lastly, the table below displays the classifications by industry, based on the SIC top-level divisions. This presents the percentage of companies in select industries having at least one KAM citing one of the top ten classification topics. Going Concern KAM topics have seen an uptick across all industries, particularly the Retail Trade and Services sector, which is among several industries that were grossly affected by the ongoing COVID-19 pandemic.

For more information about Audit Analytics, please contact us.

Interested in our content? Be sure to subscribe to receive our email notifications.