This analysis was originally posted by Audit Analytics.

According to Article 13 of the Audit Regulation of 2014 (Regulation EU 537/2014), a statutory auditor of a public interest entity (PIE) must publish an annual transparency report on the firm’s website, at the latest four months after the end of each financial year. Among other disclosures, the transparency report must include a list of public interest entities for which the statutory auditor or audit firm carried out statutory audits during the preceding financial year.

Audit Analytics tracks these reports and has collected over 5,600 transparency reports with over 172,000 disclosed PIEs, many dating back to 2010.

Public interest entities are:

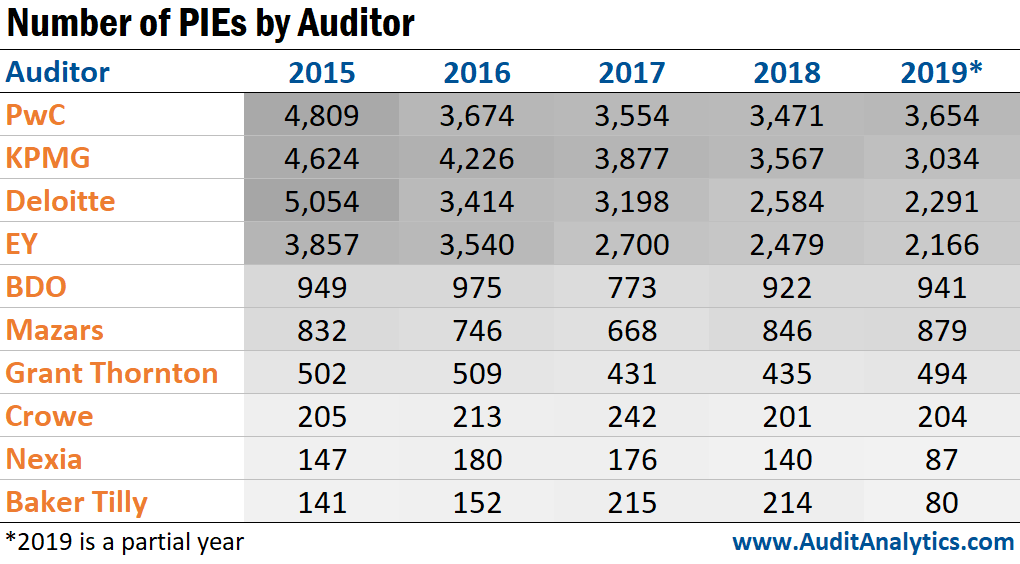

The table below shows the number of PIEs disclosed by auditor network throughout the EEA, Switzerland, and the United Kingdom. Perhaps unsurprisingly, even after the 2014 Audit Reform, the Big Four audited the most PIEs from 2015 to 2019.

Below, we’ll look at PIEs disclosed in auditor transparency reports across six countries from 2015-20191:

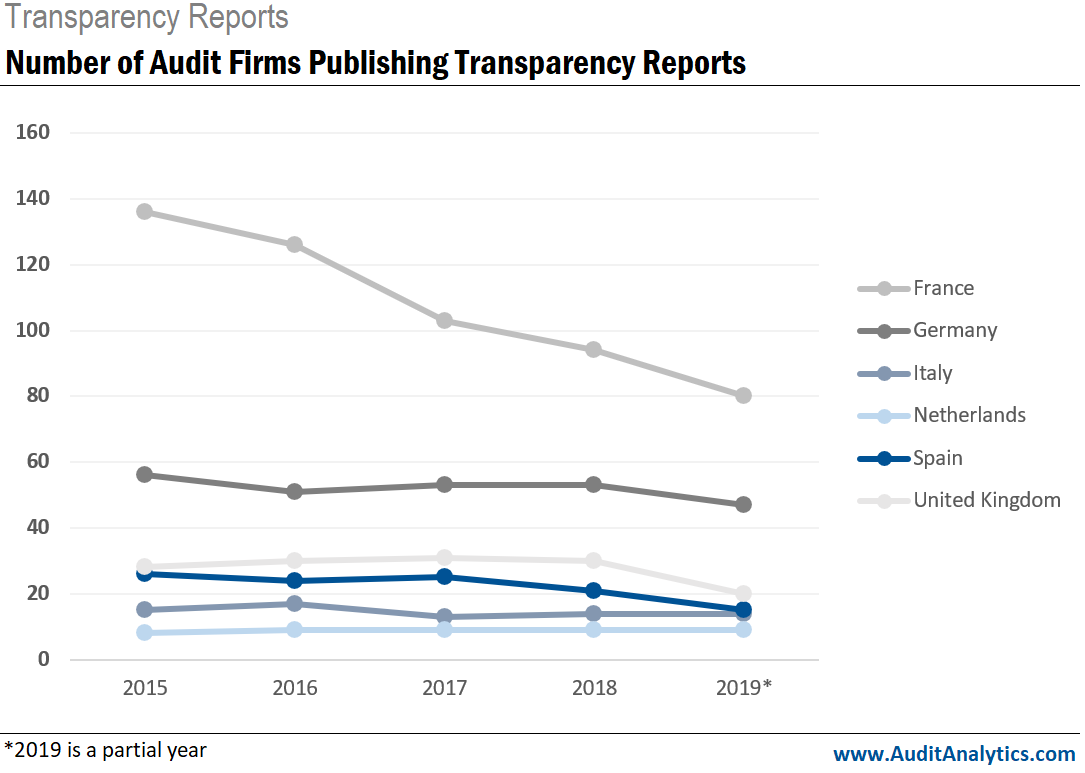

The chart below shows the number of audit firms publishing transparency reports in each of the six countries listed. While the majority of these countries saw a slight decrease in the number of audit firms publishing transparency reports from 2015 to 2019, a steeper decline can be seen in France. Although, it is important to note that 2019 is still considered a partial year.

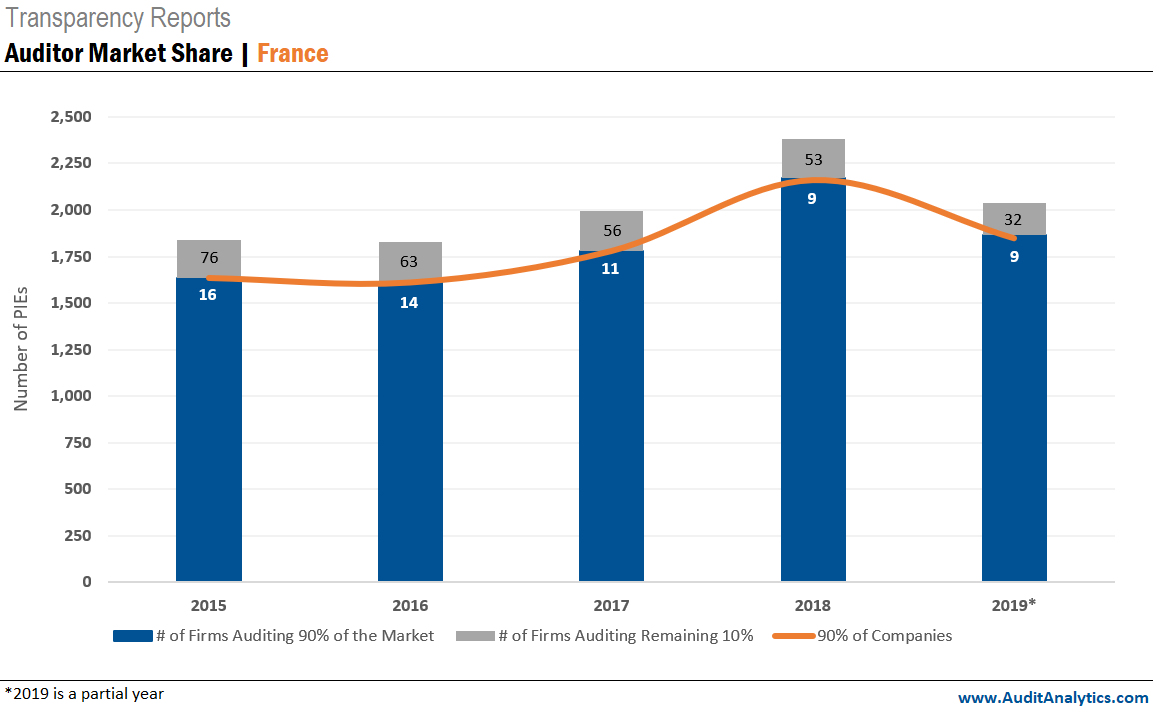

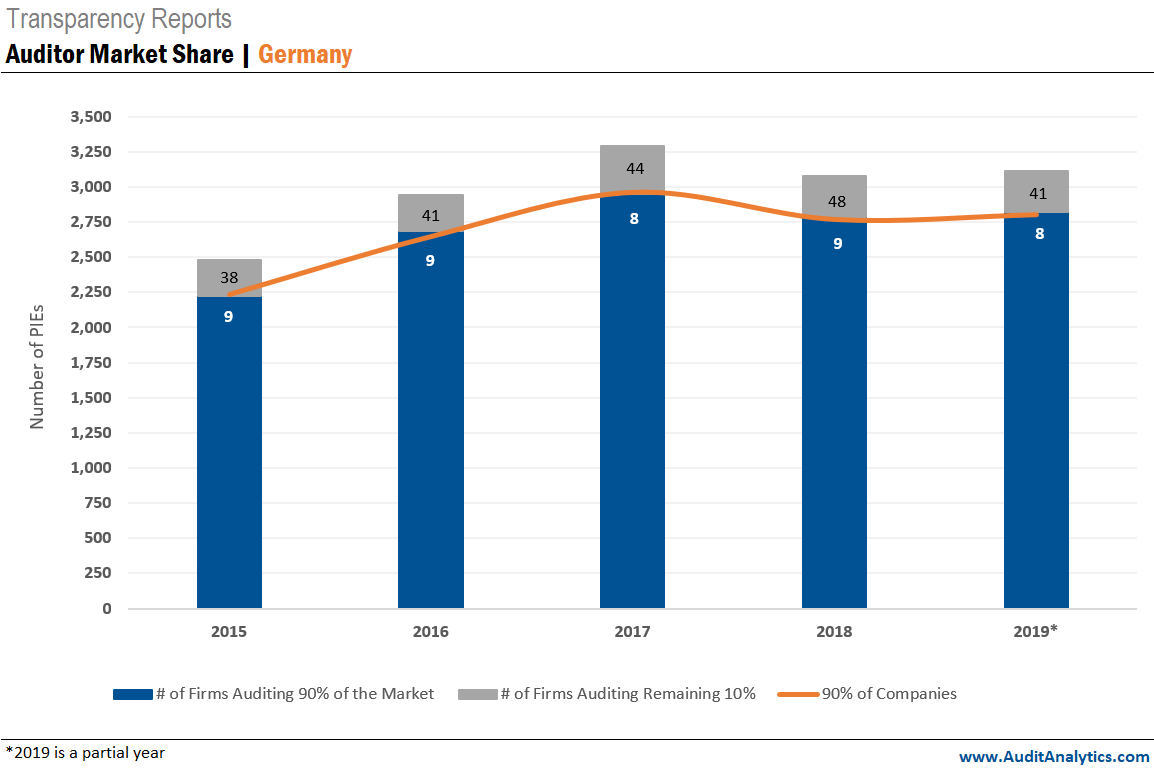

The following charts illustrate market concentration among firms that audit PIEs in France, Germany, Italy, the Netherlands, Spain, and the United Kingdom. As shown, a limited number of firms are controlling the majority of the market.

France

Interestingly, in France, the number of firms auditing the majority of the market decreased year after year, while the number of PIEs disclosed increased.

Germany

Meanwhile, in Germany, the number of firms auditing 90% of the market remained consistent, although the number of firms auditing the remainder increased – illustrating a slightly expanding market share with an increase in disclosed PIEs.

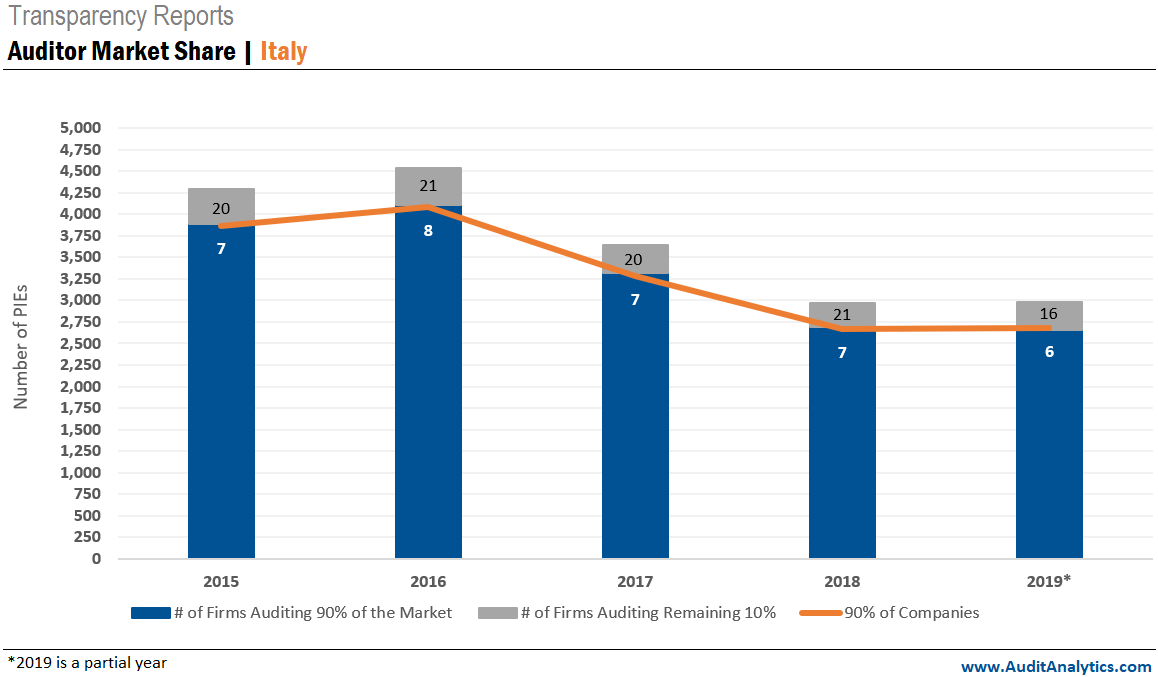

Italy

In Italy, both auditor market share and the number of PIEs disclosed seem to be decreasing.

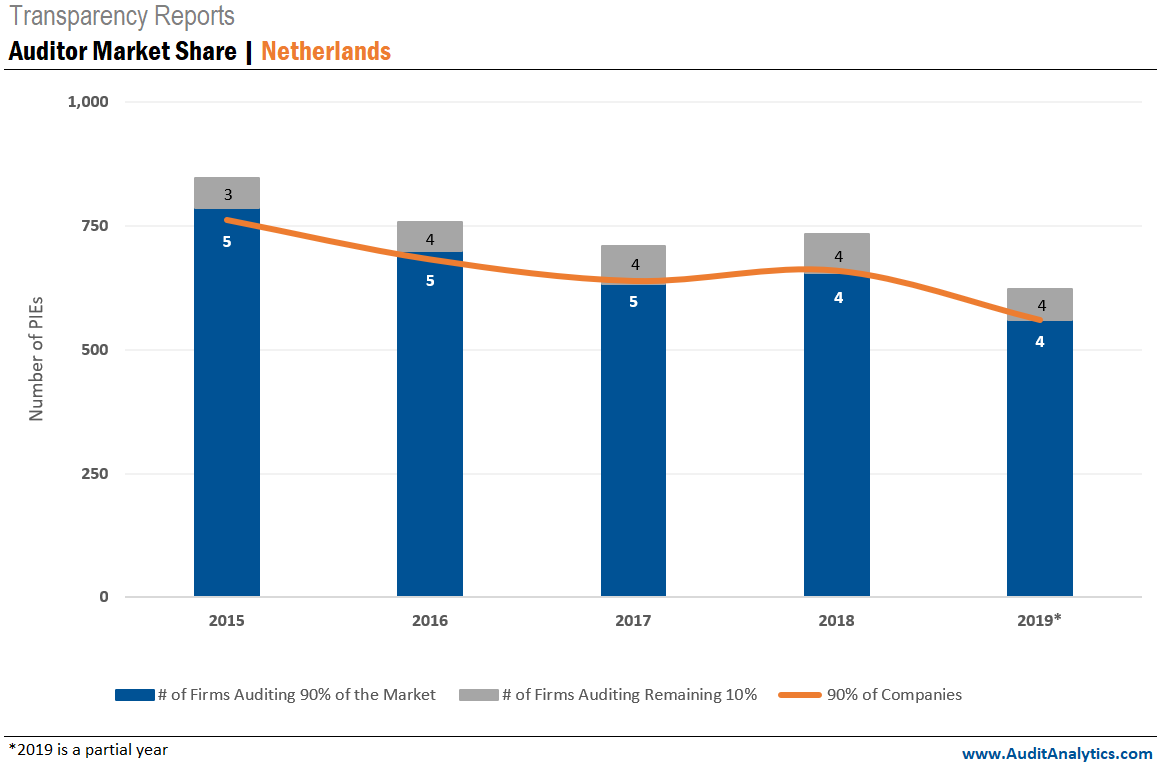

Netherlands

With the fewest amount of auditors, the Netherlands has almost as many audit firms auditing 90% of the PIE market as it does the remaining 10%. It will be interesting to see what the market share looks like after three firms left the PIE market within the last year.

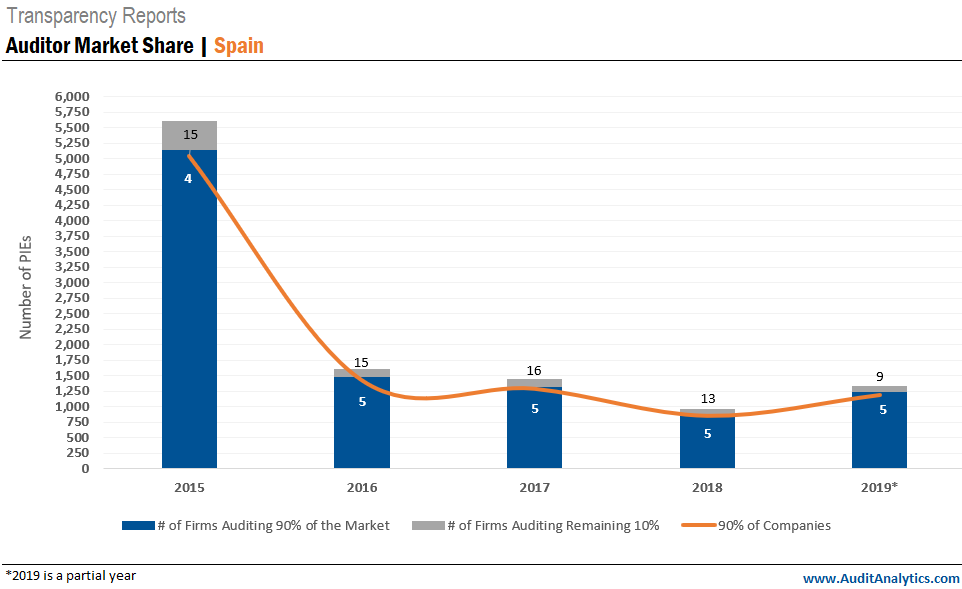

Spain

In Spain, the number of firms auditing 90% of the market has remained unchanged, with the exception of 2015. The number of PIEs in Spain decreased after 2015 due to a narrowing of the PIE definition.2 Though the number of PIEs decreased after 2015, the number of audit firms auditing the smaller PIE market has remained consistent, with a slight drop noted so far in 2019.

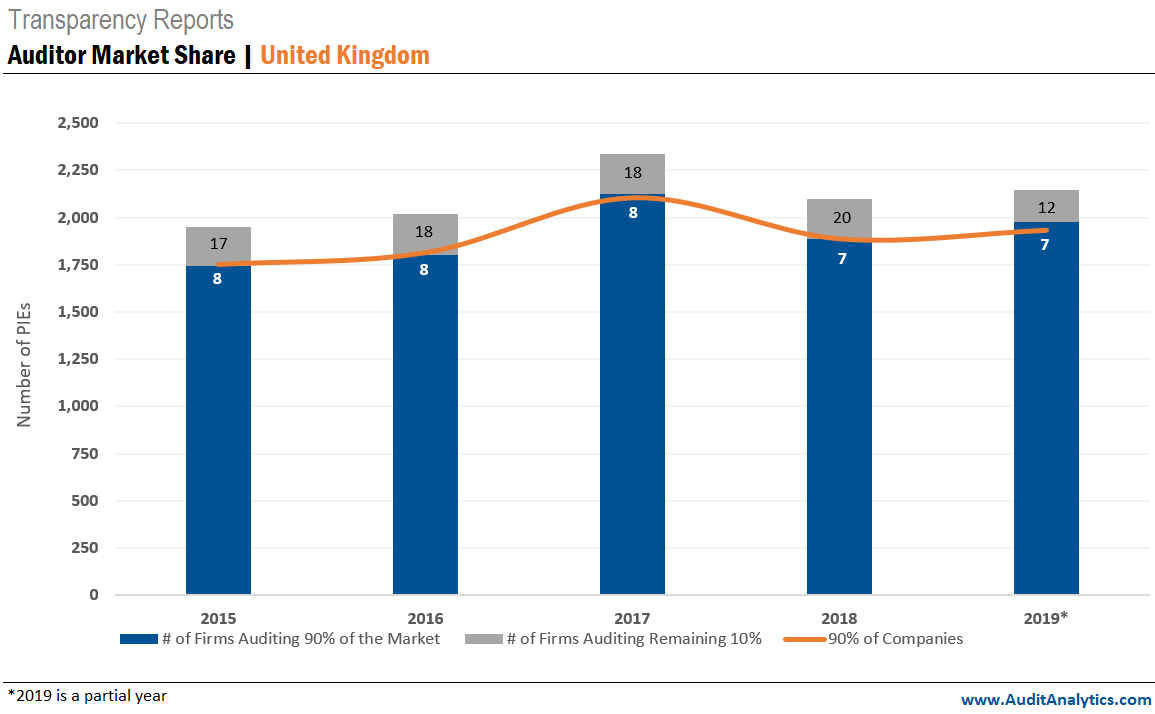

United Kingdom

The United Kingdom also shows that, despite changes in regulations, the PIE market share has remained consistent from 2015-2019.

For more information about Audit Analytics, please contact us.

Interested in our content? Be sure to subscribe to receive our email notifications.

1.2019 is considered a partial year due to delays in publications..

2.Following the implementation of the 2014 Audit Reform, regulators in Spain narrowed the definition of a PIE creating a large decrease in the disclosed number from 2015-2016.