This analysis was originally posted by Audit Analytics.

Deloitte, EY, KPMG, and PwC collectively hold just 57% of the overall market share among the top indexes in France. This is a vastly different picture than we saw when looking at Germany, where the Big Four holds 91% of the market share. The difference, however, can be attributed to France’s joint audit system.

As mentioned in a previous post, we’ll take a look at the auditor market concentration across select European countries. For this analysis, we looked at the top three French indexes trading on Euronext as of the end of 2019:

France is unique among the sizable economies in the EU because it requires a joint audit for all companies who file consolidated financial statements. While there has been no conclusive evidence about improved audit quality as a result of the joint audit approach, it is clear that in France, more accounting firms audit the top companies than in other European markets.

CAC 40

The CAC 40 is audited by six firms, with the Big Four holding 83% of the market share. EY has 23 clients, PwC has 18, and Deloitte has 14. Next is Mazars, with 11 clients, followed by KPMG auditing 10, and Grant Thornton with 2 audit clients.

CAC MID 60

The market share distribution remains in the same order for the top six auditors on the CAC 60, accounting for 91% of the index. Nexia International has 3% and is represented by ACA Auditeurs & Conseils Associés and Novances – David et Associés who audit two and one company, respectively. Cailliau Dedouit Et Associes audits two companies. Seven other firms audit the remainder of the index, each with one client.

CAC SMALL

As for the 178 companies on the CAC Small, we see a large number of audit firms competing for market share. Although, together, the Big Four, Mazars, and GT control 63% of this index. The next 20 firms hold 17% of the market, while the remaining 20% is shared among 69 audit firms. For the complete list of firms auditing the CAC Small, please contact us.

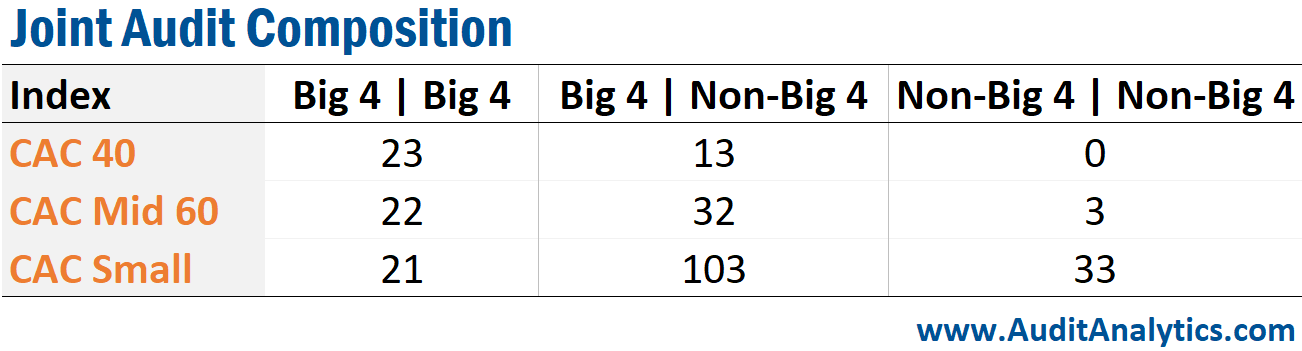

Joint Audit Market Composition

Digging deeper into how joint audits are composed sheds a little more light onto the concentration of the audit market in France. The Big Four teams up with non-Big Four firms in most joint audit arrangements on these indexes. The next most common make-up is two Big Four firms working together, and finally, two non-Big Four firms. It is clear that in France, mid-size firms have more opportunities to work on the audits of the largest companies.

Looking at the future for these indexes, it is important to note that there are a number of upcoming auditor changes that will slightly alter the landscape in 2020. On the CAC 40, Capgemini has dismissed KPMG and engaged Mazars. This will shift the Big Four market share on the top index to just under 80% and bump Mazars to 17%.

On the CAC Mid 60, we have recorded six known auditor changes:

France implemented EU Audit Reform for Public Interest Entities (PIEs) following Directive 2014/56/EU and Regulation (EU) 537/2014 of the European Parliament which took effect in June 2016.

As in much of the EU, France restricts the maximum initial audit firm tenure to ten years. France took advantage of the permitted allowance to add further requirements relating to auditor rotation, adding a minimum initial engagement of 6 years. Companies may extend and additional 14 years if there is a joint audit and 6 years if there is no joint audit. Further, there is a four- year cooling-off period during which a firm cannot be re-appointed.

France adopted most of the EU regulations as defined, with the minor exception that the Audit Committee must approve non-audit services that are not on the list of prohibited non-audit services. France also included a further provision to allow auditors to request an extension of the non-audit services cap timeline. More notably, France is unique in that they implemented a form of “Key Audit Matter” disclosure called Justification of Assessments in 2003, long before the rest of the EU in 2016.

For more information about Audit Analytics or this analysis, please contact us.

Interested in our content? Be sure to subscribe to receive our email notifications.