This analysis was originally posted by Audit Analytics.

Audit Analytics recently released the European Financial Restatements database, filling a void in stakeholders’ ability to easily analyze restatements in context of the overall global market. The database contains 350 restatements from nearly 300 public companies listed on regulated exchanges in the EEA, UK and Switzerland1 since 2018 and provides three unique methods of analyzing data:

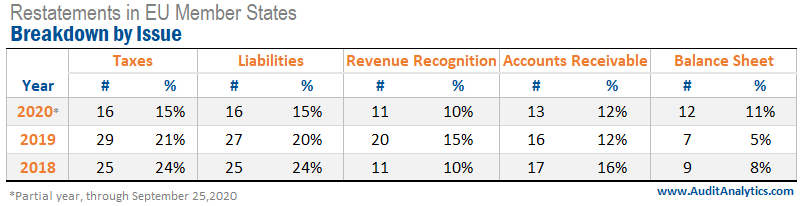

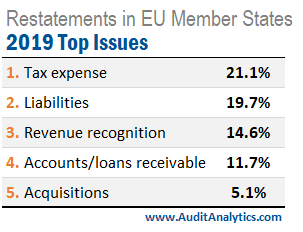

Using this database, we are able to see that for companies traded on regulated exchanges, 51% of all restatements from 2018-present are related to issues with tax expenses, liabilities, and revenue recognition.

Drilling further, we observe that issues related to liabilities, payables, reserves, and accrual estimate failures contribute to the most restatements that impact at least one full annual period. These restatements are also more likely to have a negative impact on a company’s previously disclosed financial information. Overall, 78% of restatements have a negative effect on previously reported financial statements, while 86% of restatements related to liabilities, payables, and accrual estimates are negative.

Companies have an incentive to record lower liabilities and payables, as lower liabilities positively impact financial statements. Conversely, recording higher liabilities negatively affects a company’s debt to equity ratio, a metric used by many investors to gauge risk and analyze how a company’s finances grow. It is reasonable that most restatements would negatively impact the financial statements.

Considering negative restatements for severe misstatements are higher could indicate that companies are taking more aggressive positions in recording lower amounts, auditors are not sufficiently addressing the risks associated with these accounts, or accounting for these areas could inherently result in more complexity and risk.

Such might have been the case with Sportech PLC, a London-based online gambling and entertainment company. In 2018, the Company issued a restatement for the accounting for “award points…previously charged to the income statement within marketing and distribution costs…now debited to revenue.” The restatement resulted in a reduction of £155k in prior year revenue in the sixth month period to June 2018, and £256k for the year ended December 2018, with a corresponding reduction in marketing and distribution costs.

Accrual accounting recognizes income when a performance obligation is satisfied, and unused award points represent a distinct performance obligation that will be fulfilled in the future. In this situation, IFRS 15.B40 states that “the customer, in effect pays the entity in advance for future goods or services and the entity recognizes revenue when those future goods or services are transferred or when the option expires.” The amount should have been recorded as contract liability and recognized using an estimate for the redemption likelihood over a given period. The fact that revenue and marketing & distribution were reduced indicates not only errors in liabilities classification, but also in the company’s internal controls surrounding the revenue recognition process.

Further research is needed to analyze the impact of financial restatements in European countries, and the accessibility of this data provides opportunities to easily explore European accounting quality. The release of the Europe Financial Restatements database will help researchers, investors, and auditors to better understand auditing risks, company stability, and historical trends in errors.

For more information about Audit Analytics or this analysis, please contact us.

Interested in our content? Be sure to subscribe to receive our email notifications.

1. Includes only restatements disclosed in English since 2018-01-01.