This analysis was originally posted by Audit Analytics.

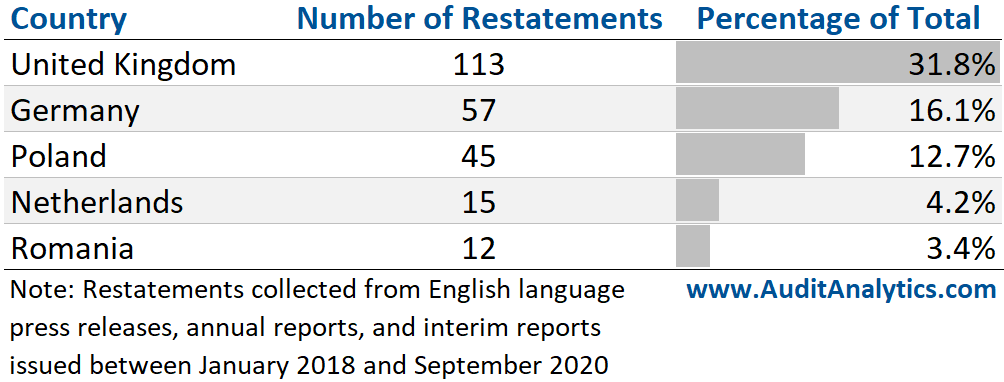

Audit Analytics recently released the Europe Financial Restatements database, consisting of financial restatements for accounting errors due to accounting rule misapplications, clerical issues, and fraud. Collected from English language press releases, annual reports, and interim reports issued between January 2018 and September 2020, the population listed on regulated exchanges contains 355 individual restatements and represents companies headquartered in 41 different countries. The top five countries represented in the database within this population and time-period are the UK, Germany, Poland, the Netherlands, and Romania.

Many financial errors may occur when issuing financial statements, and they are not always discovered before publication. In these cases, a correction to the financial statements still must be made. The scope and nature of the correction reflects the scope and materiality of the error, and can provide useful insights into the health and management practices of individual companies as well as overall financial reporting trends.

In addition to tracking which section of a firm’s financial statements has required restatement, the Audit Analytics European Restatements database also distinguishes between the following causes of error:

There is also a supplemental category for International Accounting Citations which lists any international accounting standards that were mentioned in the text of the restatement as relevant to the cause of the accounting error.

Looking at the most frequently occurring reasons for an error correction, we see that tax issues were a leading cause of restatements in the top five countries (by total), and half of all countries represented reported at least one restatement with a tax related issue.

Liabilities and accrual estimate failures, revenue recognition issues, and accounts receivable issues were each represented as a leading cause of financial restatement in at least two of the three countries with the most restatements.

Among these three countries, German restatements had a few other interesting distinctions. Inventory issues and issues with intangible assets and goodwill were relatively common in Germany, but did not appear in the top taxonomies for other countries. However, when restatements related to accounting irregularities and clerical errors are excluded from the analysis, inventory drops from the list of top taxonomies in Germany.

Also worth noting, German restatements are slightly more likely to cite IAS or IFRS in their disclosures than UK or Polish restatements, with 35% of German restatements mentioning at least one specific accounting standard.

Beyond the trends examined here across several European countries, this new database will be an invaluable resource when comparing restatement and accounting quality trends in Europe with those trends found in Audit Analytics’ long-standing US and Canada financial restatement databases.

This analysis uses data from the Europe Financial Restatements database, powered by Audit Analytics.

For more information about Audit Analytics or this analysis, please contact us.

Interested in our content? Be sure to subscribe to receive our email notifications.