This analysis was originally posted by Audit Analytics.

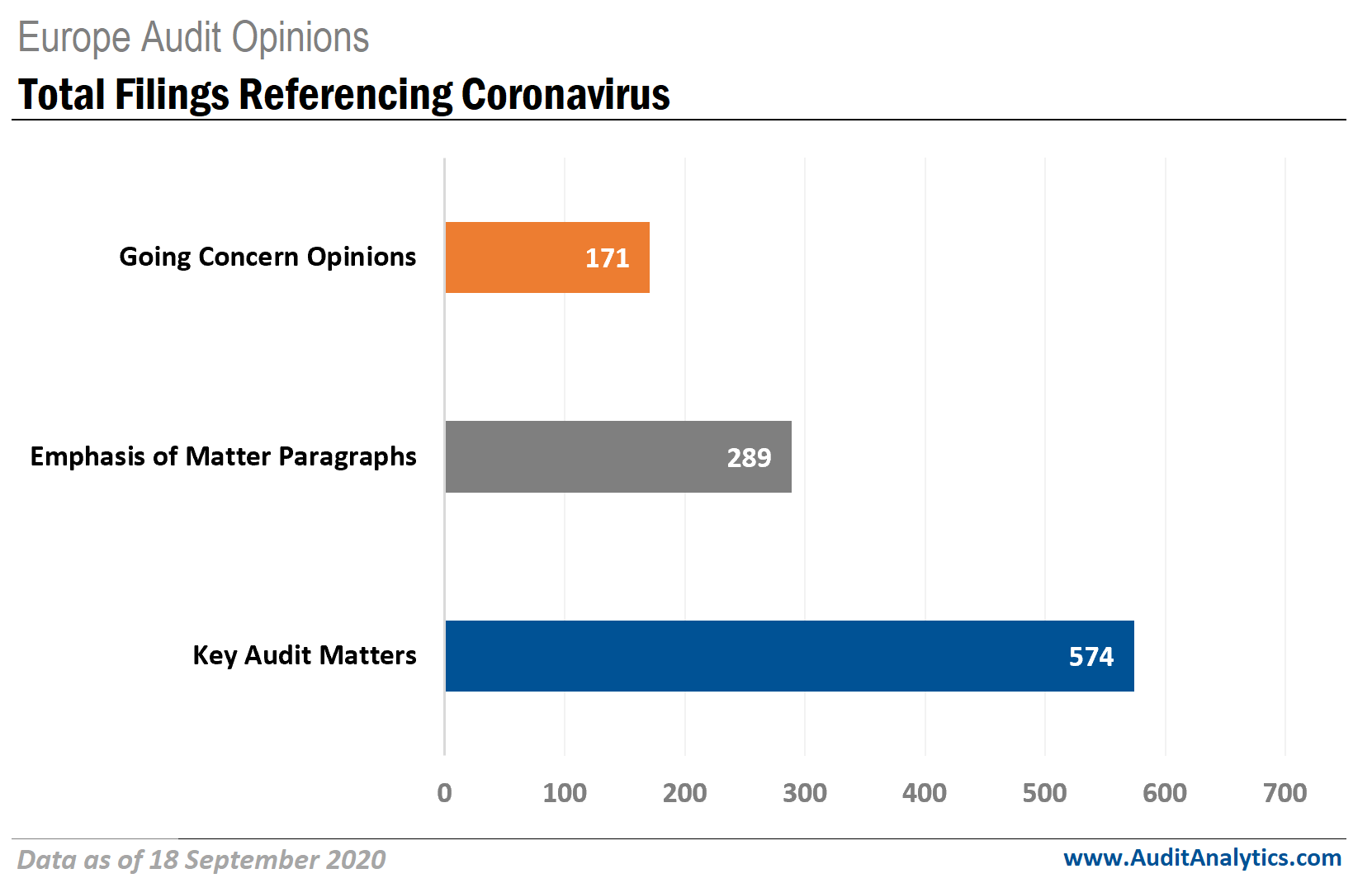

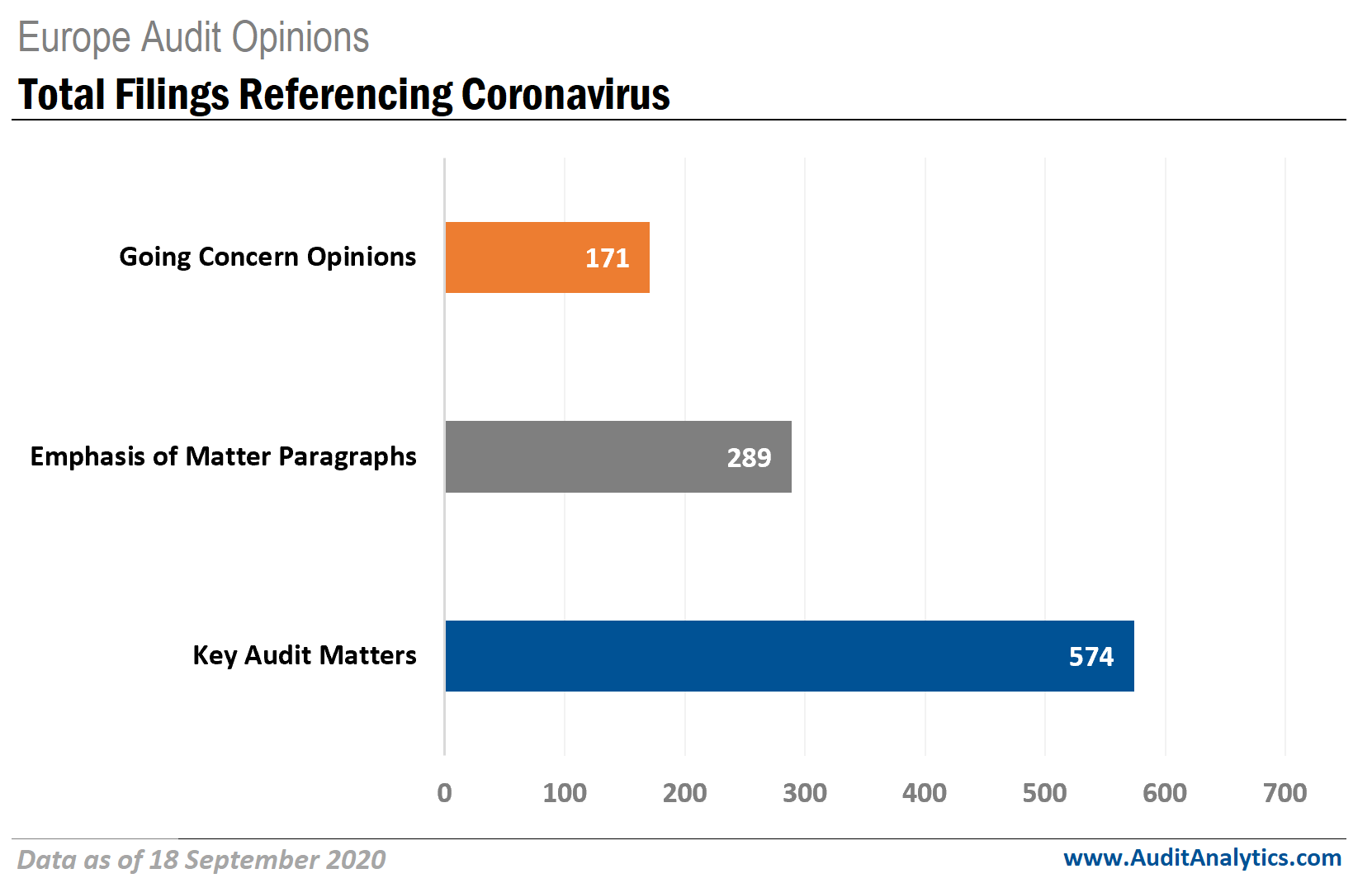

This post will be updated to reflect the current number of European audit opinions citing the COVID-19 pandemic in a going concern opinion, key audit matter, or emphasis of matter.

As of the week ended 13 November 2020, Audit Analytics has observed the following trends in European audit opinions referencing COVID-191:

A going concern modification is the expressed uncertainty that a company is able to continue in the near future. Generally speaking, this uncertainty relates to whether the company will exist for another 12 months. The specifics of the long-term and extensive impacts of the coronavirus are currently unknown, but it is known that COVID-19 has the potential to materially impact operations across a wide variety of companies.

As of the week ended 13 November 2020, non-Big Four auditors have signed the majority of going concern audit opinions for European filers referencing COVID-19. Considering many non-Big Four auditors audit smaller companies that are more likely to have uncertainty in their financials due to the pandemic, it makes sense that smaller audit firms have signed the majority of these opinions.

The vast majority (78%) of companies receiving going concern audit opinions are small- cap companies, with a market capitalization under €100 million. This observed trend remains unchanged, suggesting that smaller companies are continuing to be significantly impacted by the uncertainties surrounding the COVID-19 pandemic.

Of the companies that have received a going concern audit opinion related to coronavirus, 25% are in the Manufacturing industry and 25% are in the Services industry. As of this update, Manufacturing has slightly outpaced the Services industry in terms of going concerns that Audit Analytics has captured. For Manufacturing companies in particular, the continued economic uncertainty during the pandemic has made subjective forecasts even more challenging and complex, raising concerns in particular about the ability to cover operating expenses in the event of full or partial operational closures.

KAMs are intended to increase the usefulness and information provided in the auditor’s opinion. The disclosures made by the auditor are supposed to describe an area of significant audit risk, a summary of the auditor’s procedures to test the audit area, and any key observations of the auditor with respect to that risk (where appropriate). Considering the uncertainties regarding future impacts of the coronavirus pandemic, auditors may address the risk of that uncertainty in a KAM.

As of the week ended 13 November 2020, Big Four auditors have identified 57% of the KAMs related to COVID-19 in audit opinions for European filers in this population.

The majority (52%) of companies receiving KAMs related to the coronavirus have been small- cap companies with a market capitalization under €100 million. However, the inherent risk of the ongoing economic uncertainty and its impact on financial resources and operations spans a broad spectrum that is not limited to smaller companies.

Nearly 30% of companies that have received a KAM related to the pandemic to this point have been in the Finance, Insurance, and Real Estate industry, while 23% have been in the Services sector. The Finance sector receiving a substantial amount of COVID-19 KAMs referencing the pandemic can be partially attributed to potential impacts from an economic downturn during the pandemic that may trigger impairments related to carrying values of investments. Additionally, the valuation of financial instruments during the highly volatile market conditions of the pandemic is highly subjective and judgmental and can materially affect financial statements; this poses a significant audit risk, which may warrant its inclusion as a KAM.

An emphasis of matter paragraph is a component of the auditor’s report on financial statements that addresses matters that the auditor considers is fundamental to the overall understanding of financial statements. Given the widespread effects of coronavirus on companies and their financials, it is not surprising to see the COVID-19 pandemic mentioned as an emphasis of matter in financial statements.

As of the week ended 13 November 2020, non-Big Four auditors collectively signed 75% of opinions containing an emphasis of matter related to the pandemic, for the companies included in this analysis.

The non-Big Four majority is reflected in that roughly 77% of the companies with an emphasis of matter paragraph referencing the pandemic are small- cap companies, with a market capitalization under €100 million.

Nearly 30% of companies with an audit opinion referencing the coronavirus are in the Manufacturing industry, while 26% are in the Finance, Insurance, and Real Estate sector, and 20% are in the Services industry. As the emphasis of matter paragraph relates to components in the notes that are fundamental to a users’ understanding of the financial statements and these same industries are the most likely to have a going concern modification, it makes sense that these industries also have an emphasis of matter paragraph.

Audit Analytics Europe has 7 databases, including Audit Opinions and Key Audit Matters, that cover public companies listed on European exchanges (EEA, UK, and Switzerland).

For more information about Audit Analytics or this analysis, please contact us.

Interested in our content? Be sure to subscribe to receive our email notifications.

1.This analysis is based on audit opinions collected by Audit Analytics. Weekly totals reflect the total number of filings per week and may change over time as filings are added to the database. Firms without an identifiable auditor or available market cap are excluded from the cumulative count by auditor and market cap in the tables, but are included in the overall total. For dual signed audit opinions, both auditors are included in the auditor analyses in the table and are included in the cumulative count by auditor, but the opinion is counted only once in the overall total.

This post will be updated to reflect the current number of European audit opinions citing the COVID-19 pandemic in a going concern opinion, key audit matter, or emphasis of matter.

As of the week ended 13 November 2020, Audit Analytics has observed the following trends in European audit opinions referencing COVID-191:

A going concern modification is the expressed uncertainty that a company is able to continue in the near future. Generally speaking, this uncertainty relates to whether the company will exist for another 12 months. The specifics of the long-term and extensive impacts of the coronavirus are currently unknown, but it is known that COVID-19 has the potential to materially impact operations across a wide variety of companies.

As of the week ended 13 November 2020, non-Big Four auditors have signed the majority of going concern audit opinions for European filers referencing COVID-19. Considering many non-Big Four auditors audit smaller companies that are more likely to have uncertainty in their financials due to the pandemic, it makes sense that smaller audit firms have signed the majority of these opinions.

The vast majority (78%) of companies receiving going concern audit opinions are small- cap companies, with a market capitalization under €100 million. This observed trend remains unchanged, suggesting that smaller companies are continuing to be significantly impacted by the uncertainties surrounding the COVID-19 pandemic.

Of the companies that have received a going concern audit opinion related to coronavirus, 25% are in the Manufacturing industry and 25% are in the Services industry. As of this update, Manufacturing has slightly outpaced the Services industry in terms of going concerns that Audit Analytics has captured. For Manufacturing companies in particular, the continued economic uncertainty during the pandemic has made subjective forecasts even more challenging and complex, raising concerns in particular about the ability to cover operating expenses in the event of full or partial operational closures.

KAMs are intended to increase the usefulness and information provided in the auditor’s opinion. The disclosures made by the auditor are supposed to describe an area of significant audit risk, a summary of the auditor’s procedures to test the audit area, and any key observations of the auditor with respect to that risk (where appropriate). Considering the uncertainties regarding future impacts of the coronavirus pandemic, auditors may address the risk of that uncertainty in a KAM.

As of the week ended 13 November 2020, Big Four auditors have identified 57% of the KAMs related to COVID-19 in audit opinions for European filers in this population.

The majority (52%) of companies receiving KAMs related to the coronavirus have been small- cap companies with a market capitalization under €100 million. However, the inherent risk of the ongoing economic uncertainty and its impact on financial resources and operations spans a broad spectrum that is not limited to smaller companies.

Nearly 30% of companies that have received a KAM related to the pandemic to this point have been in the Finance, Insurance, and Real Estate industry, while 23% have been in the Services sector. The Finance sector receiving a substantial amount of COVID-19 KAMs referencing the pandemic can be partially attributed to potential impacts from an economic downturn during the pandemic that may trigger impairments related to carrying values of investments. Additionally, the valuation of financial instruments during the highly volatile market conditions of the pandemic is highly subjective and judgmental and can materially affect financial statements; this poses a significant audit risk, which may warrant its inclusion as a KAM.

An emphasis of matter paragraph is a component of the auditor’s report on financial statements that addresses matters that the auditor considers is fundamental to the overall understanding of financial statements. Given the widespread effects of coronavirus on companies and their financials, it is not surprising to see the COVID-19 pandemic mentioned as an emphasis of matter in financial statements.

As of the week ended 13 November 2020, non-Big Four auditors collectively signed 75% of opinions containing an emphasis of matter related to the pandemic, for the companies included in this analysis.

The non-Big Four majority is reflected in that roughly 77% of the companies with an emphasis of matter paragraph referencing the pandemic are small- cap companies, with a market capitalization under €100 million.

Nearly 30% of companies with an audit opinion referencing the coronavirus are in the Manufacturing industry, while 26% are in the Finance, Insurance, and Real Estate sector, and 20% are in the Services industry. As the emphasis of matter paragraph relates to components in the notes that are fundamental to a users’ understanding of the financial statements and these same industries are the most likely to have a going concern modification, it makes sense that these industries also have an emphasis of matter paragraph.

Audit Analytics Europe has 7 databases, including Audit Opinions and Key Audit Matters, that cover public companies listed on European exchanges (EEA, UK, and Switzerland).

For more information about Audit Analytics or this analysis, please contact us.

Interested in our content? Be sure to subscribe to receive our email notifications.

1.This analysis is based on audit opinions collected by Audit Analytics. Weekly totals reflect the total number of filings per week and may change over time as filings are added to the database. Firms without an identifiable auditor or available market cap are excluded from the cumulative count by auditor and market cap in the tables, but are included in the overall total. For dual signed audit opinions, both auditors are included in the auditor analyses in the table and are included in the cumulative count by auditor, but the opinion is counted only once in the overall total.