by Jochen Pierk (Erasmus University Rotterdam)

Once a year, typically end of June, Clarivate publishes the new journal impact factors. Despite some well-known shortcomings of such metrics (which I am not going to discuss in detail[1]), journal editors typically highlight the new impact factors on their websites and even advertise them on social media (when they increase). So what exactly are impact factors? Impact factors measure the number of citations in the current year of articles that were published in the two previous years (‘citable items’). For example, the 2021 impact factor is the average number of citations received in 2021 of all respective journal publications of 2019 and 2020. While impact factors are typically used only to provide an average citation count, the underlying data can also help us understand what drives impact factors, i.e., who cites accounting journals. Thus, it allows us to observe trends in the accounting landscape, and can help editors and accounting scholars identify their (academic) target audience, i.e., who is citing accounting research articles.[2]

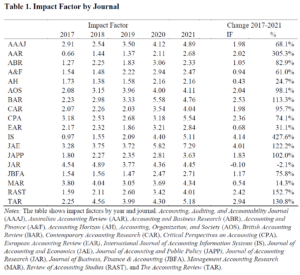

In this blog, I provide some empirical evidence on who cites accounting journals. I start the analyses by comparing the impact factors of 18 accounting journals with the highest 2021 impact factor over time (see Table 1 for the list of journals).[3] While this list obviously does not cover all potentially interesting journals, e.g., many journals with a focus on a specific topical area are missing, it covers at least a relevant set of journals for many scholars. Table 1 shows the impact factor separately for these 18 journals. In 2021, the Journal of Accounting and Economics (JAE) had the highest impact factor (7.29), followed by Critical Perspectives on Accounting (5.54), followed by The Accounting Review (5.18). In the previous year, JAE also ranked number one, followed by British Accounting Review. At the beginning of the sample period (2017/2018), the Journal of Accounting Research (JAR) had the highest impact factor, but while all other journals increased their impact factor to quite some extent, JAR’s has remained relatively stable over time. Many journals were even able to more than double their impact factor in the same time frame.

A general observation is that purely based on impact factors, there is no clear distinction on what should constitute a so-called ‘top’ journal (top-3, top-5, … also a discussion I do not want to start here). However, one should keep in mind that, in contrast to rankings such as the SJR ranking, impact factors do not take into account any weighting regarding the influence/importance of the citing source. The current 6 highest ranked accounting journals (accessed July 6th 2022) in the SJR ranking are in descending order: JAE, JAR, TAR, RAST, CAR, and the Journal of the American Taxation Association (JATA). The current impact factor of JATA is 0.73. If someone is interested in decomposing these differences and understanding the ‘weighting’ of SJR (an iterative process), read this description.

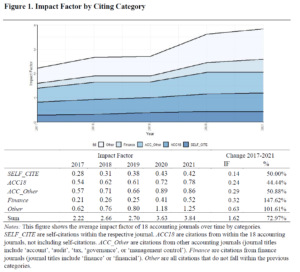

Next, I categorize the journals that cite accounting articles into several categories to better understand who cites accounting research and what drives the increase in impact factor: Self-citations (an article cites another article from the same journal), citations by the top 18 accounting journals without self-citations, other accounting journals (journal titles include ‘account’, ‘audit’, ‘tax’, ‘governance’, or ‘management control’), finance journals (journal titles include ‘finance’ or ‘financial’), and other journals. Figure 1 shows that all categories are increasingly citing the 18 accounting journals. For example, self-citations increased from 0.26 in 2017 to 0.42, which means that in 2021 the average journal article of 2019 and 2020 was cited 0.42 times by articles from the same journal. The citations within the 18 accounting journals increased similarly from 0.54 to 0.78. The relative importance of this category varies widely across journals. For example, some journals receive less than 10 percent of their citations from within the 18 journals in 2021 (AAAJ, A&F, IS), while others receive around or more than 30 percent of their citations from this category (AOS, CAR, JAE, JAR, TAR).

Another interesting observation is that the category OTHER more than doubled between 2017 and 2021 and contributes the most to the 2021 impact factor (1.25 IF points out of 3.84 are attributable to this category), which means that citations from journals that do not have a primary focus on accounting are to a large extent responsible for the increase in impact factors in the last five years.

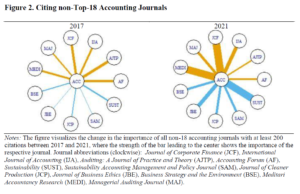

To gain a deeper understanding of citations over time, Figure 2 visualizes the change in the importance of all non-18 accounting journals that cited the 18 accounting journals at least 200 times between 2017 and 2021, where the width of the bar leading to the center shows the importance of the respective journal. As one would expect, the chart includes ‘other’ accounting journals such as Auditing: A Journal of Practice and Theory (AJTP) and Meditari Accountancy Research (MEDI), or finance journals (Journal of Corporate Finance). However, the figure also shows that especially journals covering CSR and sustainability topics increasingly cite accounting journals (in light blue). For example, the impact factors of 2017 included around 32 citations from the journal Sustainability (SUST), which increased to 167 in 2021. Similarly, the Journal of Cleaner Production (JCP) and Business Strategy and the Environment (BSE) are increasingly citing the 18 accounting journals.

In conclusion, impact factors of accounting journals have increased significantly in the past 5 years and the increase is to some extent attributable to citations from journals that cover CSR and sustainability topics. Topics such as disclosure of CSR, and sustainability and climate (change) topics in general receive more academic citations from non-accounting journals, thereby increasing their impact factors. For example, Bebbington and Unerman (2018, AAAJ) and Chen, Hung, and Wang (2018, JAE) cover CSR and sustainability topics and both papers counted 81 citations for the 2020 impact factor, far more citations than the third-highest citation count within the last 5 years (Nagar, Schoenfeld, and Wellman (2019) received 60 citations for the 2021 impact factor). Since determinants of CSR reporting are often similar to those of financial reporting (Christensen, Hail, and Leuz 2021), accounting research can (and does) play a crucial role in further studying this interdisciplinary topic.

At face value, it seems that scholars outside of our field of accounting are more and more noticing our work. However, this might also partly be driven by accounting scholars publishing more in journals that do not have a primary accounting focus and then citing previous work in accounting. There might be good reasons for publishing outside of our ‘standard’ journals, e.g., increasing interdisciplinarity, but increasing pressure to publish might also incentivize opportunistic behavior to publish in journals with lower standards and easier review processes (in the worst case so-called predatory journals), which in turn could increase impact factors of accounting journals. To be clear: The analyses in this little essay do not allow for any conclusion in this respect nor do I imply that any of the mentioned journals are of low quality, but it is important to keep in mind what Impact Factors are and how they are used.

References

Bebbington, Jan, and Jeffrey Unerman. 2018. “Achieving the United Nations Sustainable Development Goals: An Enabling Role for Accounting Research.” Accounting, Auditing & Accountability Journal 31 (1): 2–24. https://doi.org/10.1108/AAAJ-05-2017-2929.

Chen, Yi-Chun, Mingyi Hung, and Yongxiang Wang. 2018. “The Effect of Mandatory CSR Disclosure on Firm Profitability and Social Externalities: Evidence from China.” Journal of Accounting and Economics 65 (1): 169–90. https://doi.org/10.1016/j.jacceco.2017.11.009.

Christensen, Hans B., Luzi Hail, and Christian Leuz. 2021. “Mandatory CSR and Sustainability Reporting: Economic Analysis and Literature Review.” Review of Accounting Studies, July. https://doi.org/10.1007/s11142-021-09609-5.

Nagar, Venky, Jordan Schoenfeld, and Laura Wellman. 2019. “The Effect of Economic Policy Uncertainty on Investor Information Asymmetry and Management Disclosures.” Journal of Accounting and Economics 67 (1): 36–57. https://doi.org/10.1016/j.jacceco.2018.08.011.

[1] In fact, Clarivate mentions that it ‘does not depend on the impact factor alone in assessing the usefulness of a journal, and neither should anyone else’ (https://clarivate.com/webofsciencegroup/essays/impact-factor/, accessed July 7th, 2022).

[2] Impact factors only measure academic citations, not the ‘impact’ research has on society.

[3] The initial screening included the top 20 journals, but due to missing data on 2017, Accounting Forum and the Journal of Contemporary Accounting and Economics are not included.